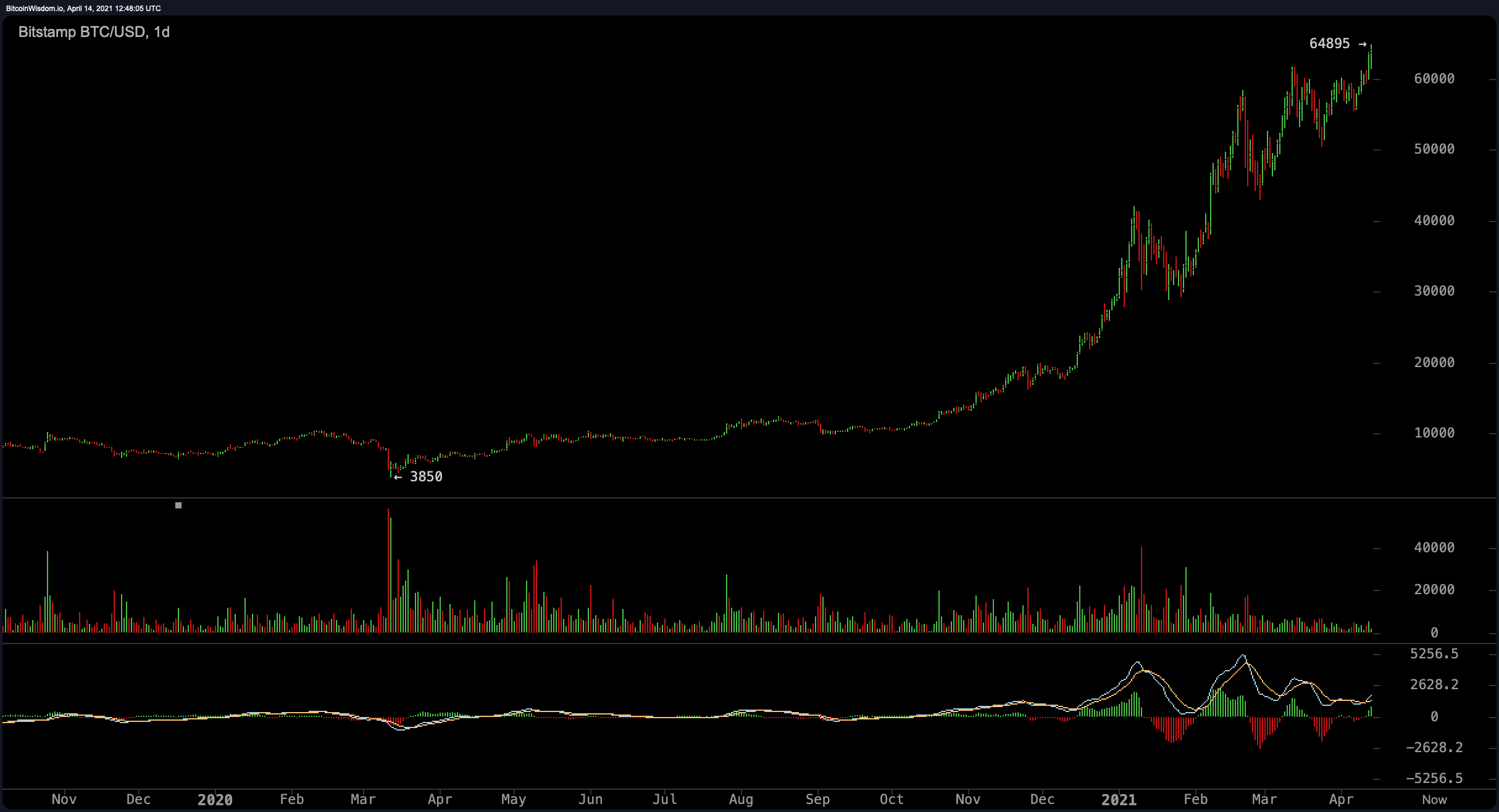

Cryptocurrency markets have been surging during the last 24 hours, as billions of dollars have flooded into the crypto-economy. Bitcoin’s value touched an all-time high (ATH) once again on Wednesday morning (EST), reaching $64,895 per unit. The latest price rise is leading up to the upcoming Coinbase direct listing on Nasdaq.

Crypto-Economy Surpasses $2.2 Trillion in Value

Digital currency fans are quite pleased on Wednesday morning, as a slew of new gains has been recorded across the entire crypto-economy. The entire crypto-economy is currently valued at $2.2 trillion and is up over 4% today. Bitcoin (BTC) touched a high of $64,895 per unit and is currently trading for $64,229. BTC is up over 2.6% today and up 15.5% during the last seven days. Despite the new ATH, bitcoin (BTC) dominance among the 9,215 cryptocurrencies in existence is only 53% today.

Ethereum (ETH) has captured some of that dominance as the crypto asset ether is swapping for $2,380 per unit. This means that ETH now has 12.3% of the entire market capitalization. ETH is up 7% today and 21% for the week. Behind ETH is binance coin (BNB), which is trading for $572 per coin. BNB has jumped 1.9% today and a whopping 52% during the last week. XRP has managed to push tether (USDT) out of the fourth position as it currently trades for $1.82 per unit.

Cardano (ADA) is trading for $1.46 per coin, polkadot (DOT) is swapping for $42, and litecoin (LTC) is hovering around $272 per coin. Uniswap (UNI) is currently trading for $35 per unit and is up 1.3% today. The tenth-largest market position is held by dogecoin (DOGE) trading for $0.141 and is up a significant 86% on Wednesday. DOGE has been the forerunner as far as 24-hour gains are concerned among the top ten leading crypto assets.

#Bitcoin is now the 6th largest currency in the world, and has overtaken the British pound sterling in monetary base size pic.twitter.com/rlX9JWhMn6

— Documenting Bitcoin 📄 (@DocumentingBTC) April 14, 2021

‘Bitcoin Is Expanding its Range’

Just before the Coinbase direct listing and as BTC has touched a new ATH, a great number of investors and crypto executives are very positive. “Bitcoin has been continuously moving out of its niche, that’s no secret,” Eric Demuth, Co-CEO and founder of Bitpanda explained to Bitcoin.com News. “Whether it is its greater coverage in mainstream media, or the adoption of Bitcoin trading infrastructures by major banks such as JPM or Goldman Sachs. The decisive step was probably the first investments made by S&P 500 companies.”

Demuth further added:

Today, Bitcoin is expanding its range of private customers and is becoming increasingly important as an investment object for companies and pension funds. It’s record-smashing rally seen in recent weeks was partly driven by the entry of institutional money to the market. And yet, it seems as if opinions have become polarized leaving only two extreme positions on the subject: those who see this cryptocurrency as the holy grail and those who still refer to it as a purely speculative object and try to devalue Bitcoin with outdated and false myths.

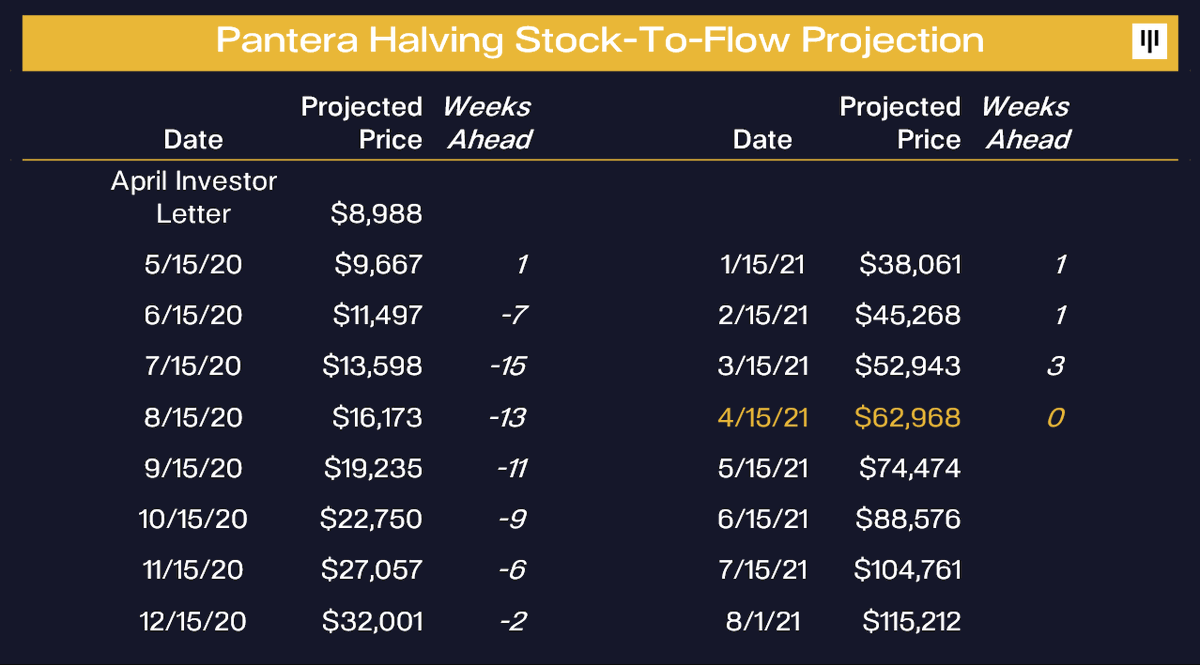

Pantera Capital Predicted Bitcoin’s Current Price Range Last Year

Additionally, many others are quite optimistic about the market movements and BTC’s latest ATH. Dan Morehead, the CEO of Pantera Capital explained that his firm predicted these prices.

“This is getting ridiculous. A year ago we predicted Bitcoin hitting $62,968 this week. It just did. This Bitcoin rally is EXACTLY like previous halvings. Likely to reach $115k by August,” Morehead tweeted. The company also published the firm’s April 2020 Investor Letter which shows the firm’s prediction.

Want to see all the crypto market action in real-time? Check out markets.Bitcoin.com today!

What do you think about bitcoin tapping a fresh new all-time high ahead of the Coinbase listing? Let us know what you think about this subject in the comments section below.

Powered by WPeMatico