Among the stories from around the cryptosphere featured in today’s edition of Bitcoin in Brief are a fake Trezor wallet website and floods in China that reportedly took out enough mining farms to make a dent in the global hash rate, as well as a couple of new investments in the field.

Also Read: Cryptojacking Rises as Ransomware Declines, Cyber Security Researchers Find

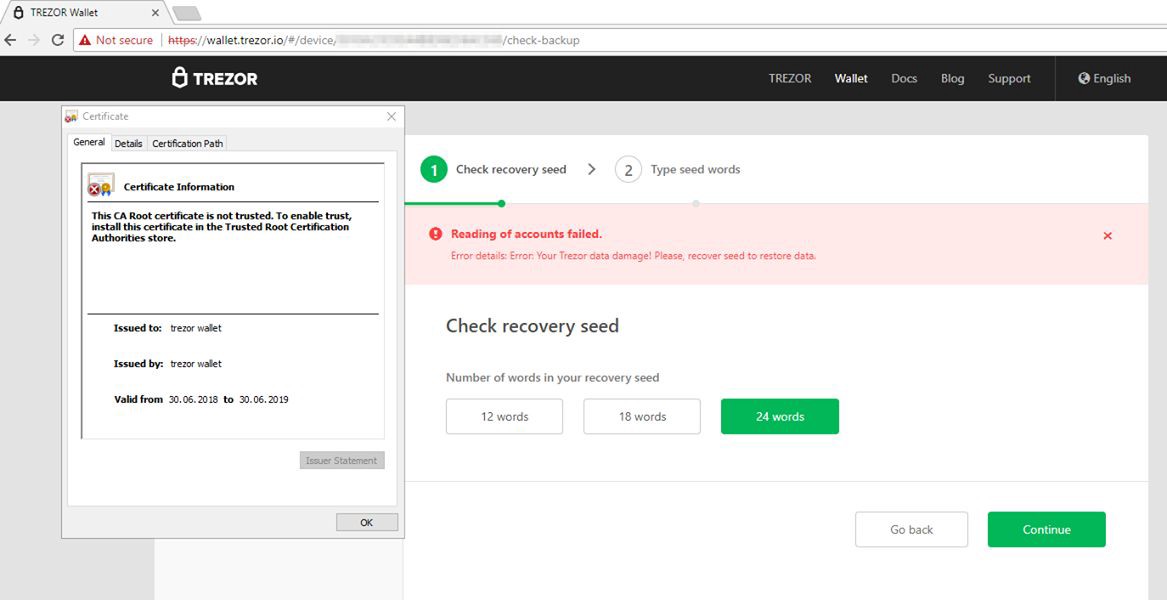

Fake Trezor Wallet Website

Bitcoin hardware wallet manufacturer Trezor has issued a warning to clients about an appeared phishing attempt against its users. A fake Trezor Wallet website was served to some users who attempted to access the legitimate address (wallet.trezor.io). The developers explain that they do not yet know which attack vector was used, but the signs point toward DNS poisoning or BGP hijacking. Thankfully, the fake wallet has been taken down by the hosting provider. However, Trezor asks clients to remain vigilant and report all suspicious sites as it is possible that this attack method will be used again in the future.

Floods Take Out Mines in China

Sichuan province in southwest China is a mecca for cryptocurrency mining thanks to the region’s plentiful and cheap hydro-power electricity. Unfortunately, the same abundance of rivers and rainfalls that give it this advantage, also makes Sichuan prone to seasonal floods. In July, 2013, dozens of people died as a result of large floods and an estimated six million people in the region had their daily lives interrupted in some way. Now, with the return of the floods season, the many local miners are also affected according to reports from the country, mainly due to communication and power outages as well as mining farms being outright under water. By examining the global BTC hash rate it is possible to see that there was a drop in late June, coinciding with the floods, but not to unprecedented levels.

Qiwi Team Launches Crypto Investment Bank

A team of employees from the Russian payment services Qiwi is reportedly setting up a separate company meant to be a crypto investment bank. The same way that traditional investment banks help startups attract strategic and venture capital investors, a crypto investment bank helps ICOs secure investments from crypto funds. “We help companies go through the stage of fundraising. Monetization is classic: we get our commission after the company with our help raised funds in the market, ” financial director of Qiwi Blockchain Technologies Yakov Barinsky told Kommersant. According to Mr. Barinsky, the company now cooperates with ten such funds, the largest of them is worth about $100 million.

A team of employees from the Russian payment services Qiwi is reportedly setting up a separate company meant to be a crypto investment bank. The same way that traditional investment banks help startups attract strategic and venture capital investors, a crypto investment bank helps ICOs secure investments from crypto funds. “We help companies go through the stage of fundraising. Monetization is classic: we get our commission after the company with our help raised funds in the market, ” financial director of Qiwi Blockchain Technologies Yakov Barinsky told Kommersant. According to Mr. Barinsky, the company now cooperates with ten such funds, the largest of them is worth about $100 million.

Tzero Reaches $160M Deal with Hong Kong Investors

Tzero, the crypto subsidiary of Overstock, announced the signing of a letter of intent with GSR Capital, a private equity firm registered in Hong Kong, to participate in its Security Token Offering (STO). GSR will purchase $160 million in security tokens pursuant to the Simple Agreement for Future Equity (SAFE), at a price per token of $10. Proceeds will be used, among other things, to build the US-regulated security token exchange. Executive Chairman Patrick M. Byrne (the CEO Overstock) said, “Years ago we saw the world-shaking potential of blockchain, and since then we have been methodical in building tZERO into a company that will bring great efficiency and transparency to capital markets domestically and abroad. I truly believe what we are doing is historic and, while there is still much to be done, our success in this STO has given us the resources we need to see it through.”

What do you think about today’s news tidbits? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post The Daily: Fake Trezor Website, Floods Take Out Mines, and New Crypto Investments appeared first on Bitcoin News.

Powered by WPeMatico