Cryptocurrencies markets have been volatile and very indecisive over the last 48-hours as the entire digital asset economy lost billions in value since US regulators postponed their decision concerning the Cboe/Vaneck BTC-based exchange-traded fund (ETF) last week. This Saturday, August 11, during the afternoon’s digital currency trading sessions (EDT), cryptocurrency trade volumes and price values are seeing some slight recovery.

Also Read: Wormhole Mainnet and Developers’ Guide Launched

Saturday Trading Sessions Show Some Market Rebounds

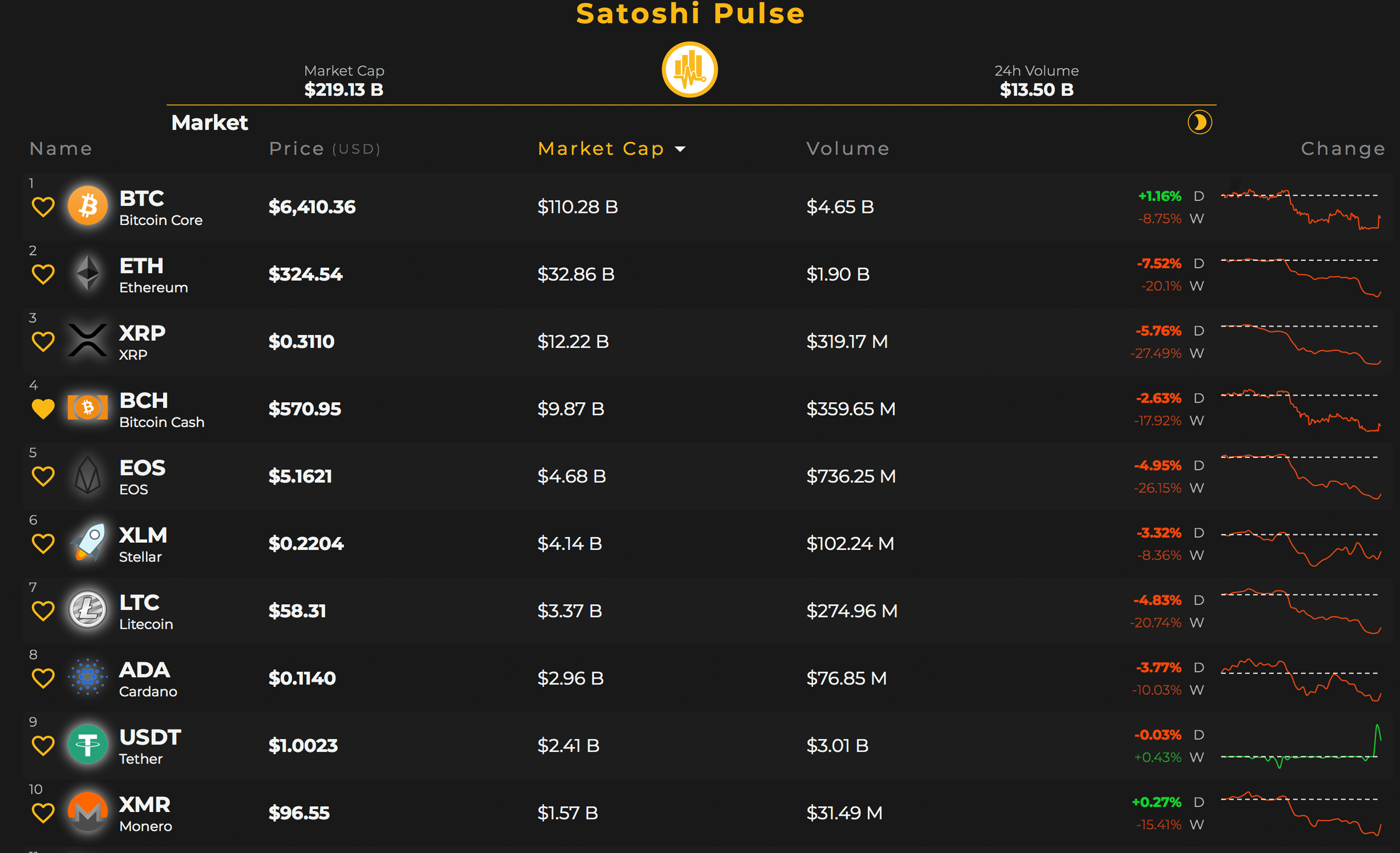

At the moment a vast number of digital assets have rebounded back a hair after being smashed down by bearish forces over the last two days. At the time of writing the entire cryptocurrency economy is valued at $219B and there’s been $13.5B worth of digital assets traded over the last day. The top cryptocurrency market capitalizations are seeing some recovery after dropping very low during the early morning trading sessions. For instance, bitcoin core dipped to a low of $6,062 this morning, but around 1 pm EDT BTC/USD market valued pumped back up to a high of $6,494 per coin. However, most coins besides BTC have lost significantly more and BTC’s market dominance among all 1,600+ capitalizations has crossed the 50 percent region.

Bitcoin Core (BTC) Market Action

At the time of publication, the price of bitcoin core (BTC) per coin is roughly $6,390 on Bitstamp. The currency’s market valuation is $110B and there’s been $4.6B traded over the last 24-hours. The top trading platforms swapping the most BTC today includes Bitflyer, Okex, Binance, Bitfinex, and Fcoin. The biggest pair traded with BTC on August 11 is tether (USDT) which is capturing 54 percent of trades. This is followed by USD (25.6%), JPY (9.7%), EUR (3.12%), and BCH (2.6%).

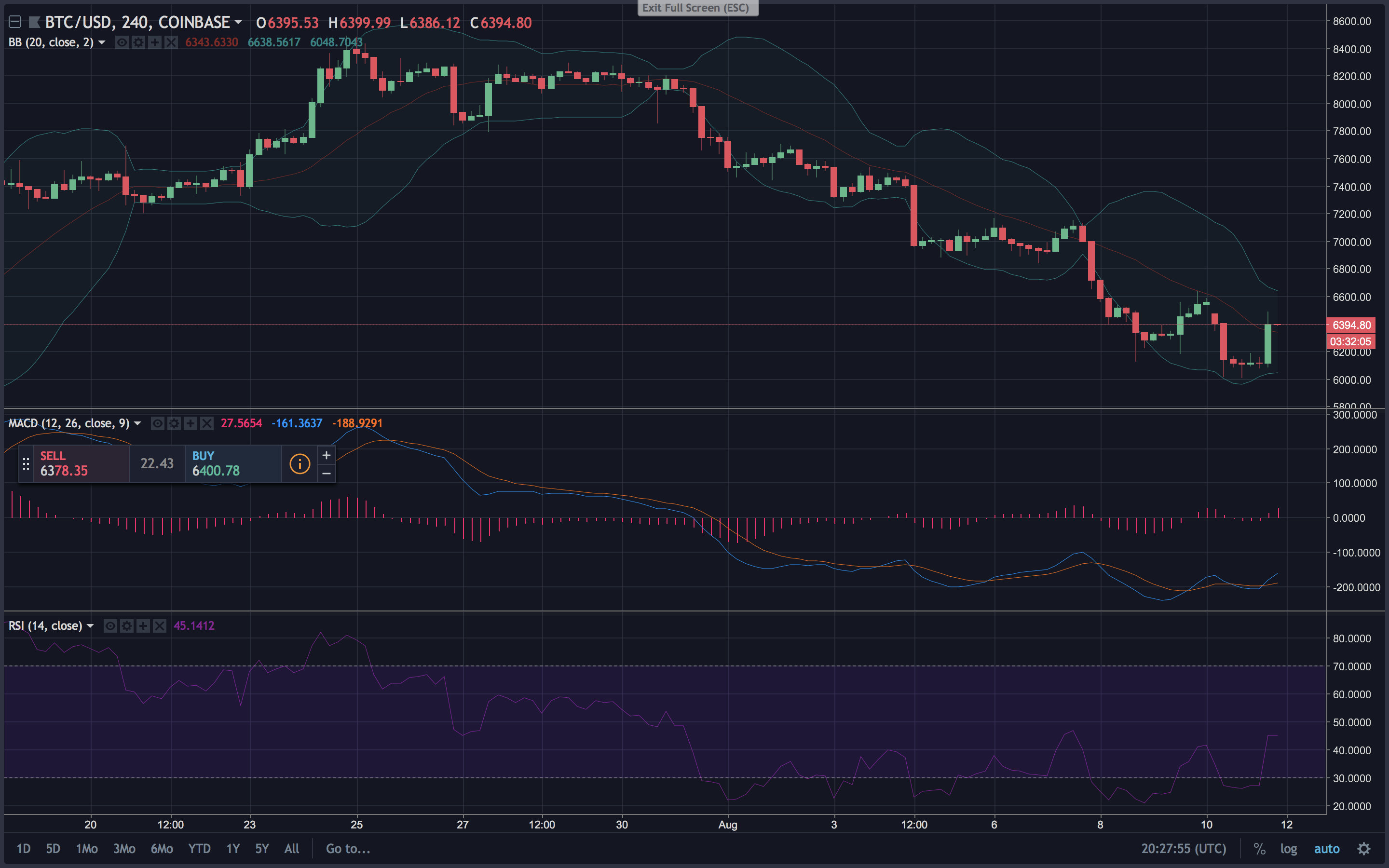

BTC/USD Technical Indicators

After the quick pump up, BTC/USD charts are moving sideways for the time being after losing a touch of the gains. Right now the 4-hour BTC chart on Bitstamp and Coinbase show the MA100 is above the MA200 but the trend lines look like they may cross hairs. Currently, this indicates the path of less resistance could be towards the upside if things stay positive. RSI levels are mid-range (47.15) confirming indecisiveness at the moment, for now, buyers are able to keep the current support afloat. Looking at order books on the upside is not so bad if BTC bulls keep pressing without exhaustion. There will be definite pit stops at $6,650 through $7K for bulls to penetrate the higher ground. On the flipside, if bears can manage to fight harder then things will be tough for them at $6,100-6,200 and broader support at $5,850.

Bitcoin Cash (BCH) Market Action

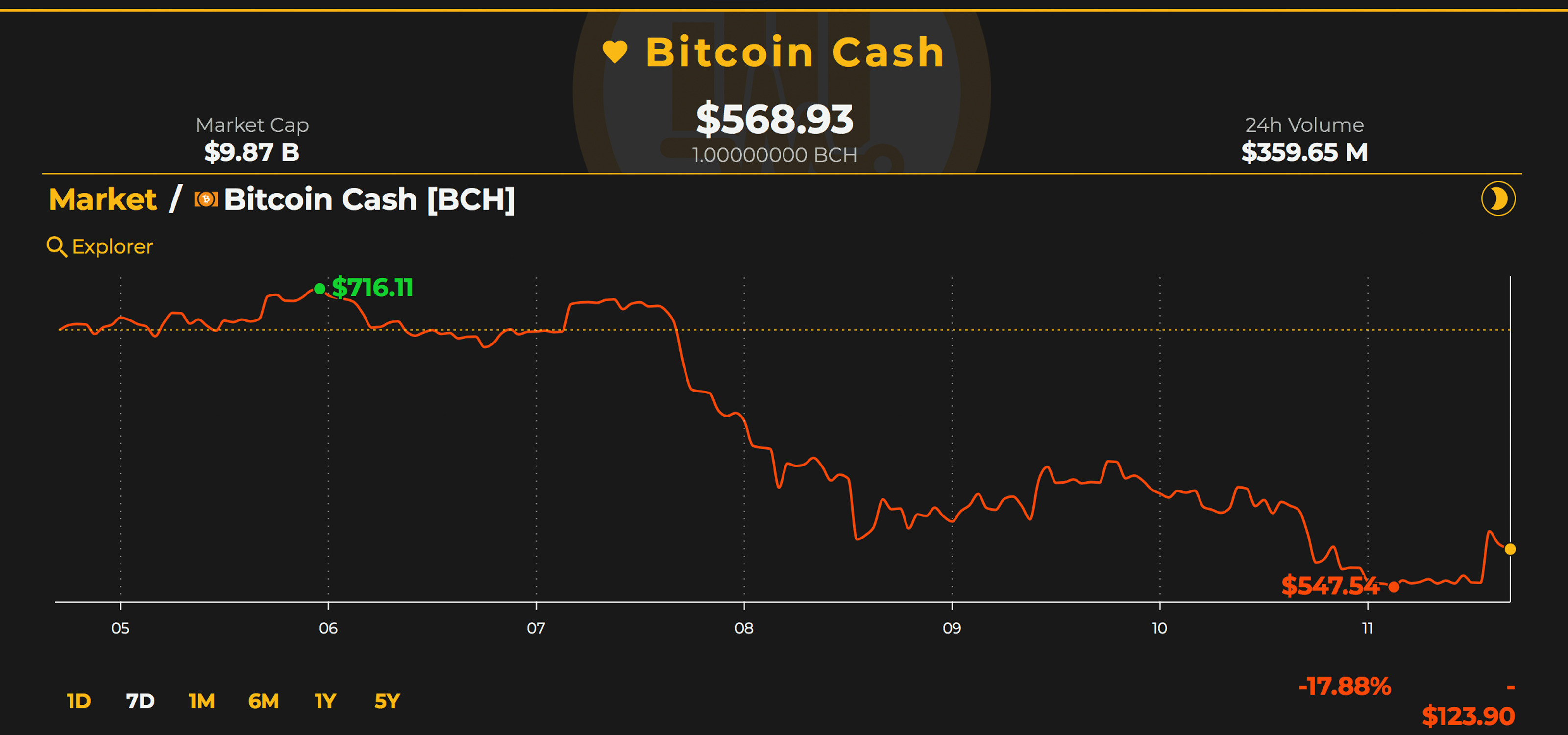

Bitcoin cash (BCH) prices are around $568 per coin right now and the overall market valuation of BCH is $9.87B today. BCH markets hold the fifth highest trade volume above ripple (XRP) and below EOS. There’s been $359M worth of BCH traded over the last 24-hours and the top BCH exchange today is Coinex. The other top exchanges swapping the most BCH this Saturday includes Okex, Binance, Huobi, and Hitbtc. Tether (USDT) captures the most BCH trades today with 56 percent of all bitcoin cash swaps. This is followed by BTC (27.5%), USD (9.2%), QC (2.3%) and ETH (1.9%).

BCH/USD Technical Indicators

Looking at charts today shows BCH markets have also seen a small uptick in price values this Saturday. The MA200 is above the MA100 trendline which could mean some downside dips after the day’s higher percentages. RSI levels (38) are lower than BTC as BCH/USD trading session showing signs of bears getting exhausted. Similarly to BTC/USD prices, BCH peaked earlier but since then the heat has simmered down. Looking at order books towards the northside shows BCH bulls must muster up enough energy to surpass resistance between the current vantage point and $600. Beyond that, there could be another pitstop around $650 per BCH as well. If bears find a way to bring markets down again there’s plenty of foundational support at $550 through $530.

The Verdict: Short-Term Uncertainty and Indecisive Markets

As we stated above the verdict this weekend is uncertainty mixed with a dose of indecisive markets. With the ETF decision postponed and the past seven months of pumps and dumps its hard to know what’s in store for cryptocurrency values over the next few weeks.

For now, prices are showing signs of consolidation and traders are moving into new positions — While some traders definitely are hoping to catch some cheap prices others think a reversal may be in the cards soon.

Where do you see the price of BTC, BCH and other coins headed from here? Let us know in the comment section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Crypto Prices Consolidate After Some Volatility appeared first on Bitcoin News.

Powered by WPeMatico