The dominance of the United States dollar as a settlement currency in Africa is being challenged by emerging payment methods in financial technology and by native African fiat currencies. In the four years to 2017, fewer people in the continent of 1.2 billion transacted via the US dollar than they did with their local currencies or mobile money, and perhaps cryptocurrency.

Also read: Steve Hanke: Central Banks Fuel Wealth Loss And Inflation – The World Needs Less Of Them

Digital Transactions Rise As US Dollar Slowly Loses Its Hegemony

At one time gold was the world’s most preferred currency before it was replaced by paper money. After World War II, the United States dollar became the backbone of the world’s reserve currency system due to its strength and stability. But that is beginning to change.

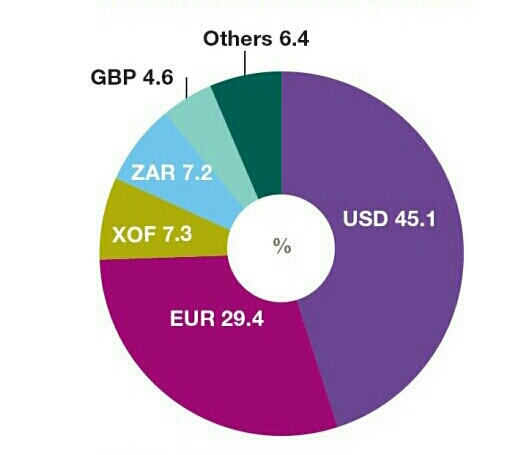

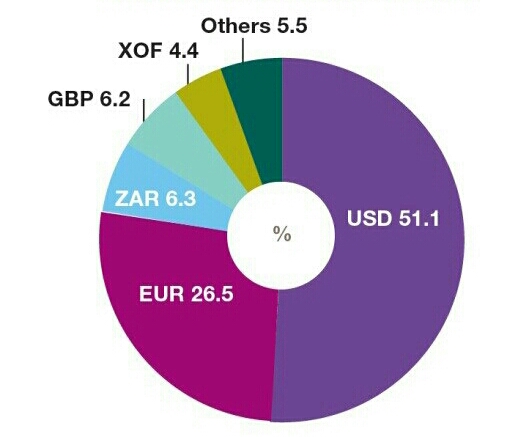

According to a new report by SWIFT, the USD is losing its hegemony as an inter-continental, cross-border settlement currency in Africa. The use of the US dollar has dropped as a share of payments from Africa from 50% in 2013 to 45.1% in 2017, it says.

More people are switching to local currencies, and some others to mobile money, for cross-border payments. Payments in the West African franc – used by 8 countries – increased from 4.4% in 2013 to 7.3% in 2017 while transactions in the South African rand – used mostly in Southern Africa – rose to 7.2% from 6.3%.

The report, which maps commercial payment flows against financial flows in Africa, highlighted that since 2014, the percentage of Sub-Saharan Africans with traditional financial accounts has not changed.

But the percentage of mobile money users has doubled, to 21 percent. This is shown by an increase in financial payments made through mobile money from 5.5% in 2013 to 6.4% in 2017.

SWIFT, which connects 11,500 financial companies in 200 countries, forecast that financial technology “will play an increasingly important role in defining Africa’s financial landscape.”

“While the US dollar still dominates, it is releasing its hold,” said SWIFT in its latest report titled “Africa Payments: Insights Into African Transaction Flow.”

About about 20% (16.7% four years ago) of “all cross-border commercial payments were credited to an African beneficiary,” indicating “that more goods and services are being bought and sold within Africa.”

Intra-African clearing of payments has also increased, from 10.2% in 2013 to 12.3% in 2017, which shows that an “increasing number of payments are being routed through Africa instead of via a clearing bank outside of Africa.”

Cryptocurrency ‘Goldfield’

It is difficult to work out how cross-border payments are going to play out in Africa in future. But the trajectory points towards an escalation in mobile-based settlements.

SWIFT data shows that about 6.4% of all payments within, or from Africa, were done by means other than any form of fiat currency. This includes peer-to-peer digital payments over the phone that may expand to cover cryptocurrency, which is not necessarily captured in mainstream data.

But more than a dozen African countries have plugged into cryptocurrency in the last couple of years, with one crypto-focused operation or another launched, even though regulation remains an area of uncertainty.

According to GSM Association, which represents mobile operators globally, there will be 725-million mobile phone subscribers in Africa by 2020 – a development that is seen as key to driving the adoption and development of cryptocurrency on the continent while boosting intra-African trade.

“With mobile money and other digital financial services, people can store money securely, spend it effortlessly, and afford the small fees charged by their providers,” SWIFT says.

Trade Dynamics Are Changing Within Africa

The report comes at a time when most Africa is investing in financial market infrastructures (FMIs) that are linking up many countries within the continent. Policymakers recognize that payments systems and other infrastructure are an enabler for economic growth.

Early this year, African leaders launched the continent’s biggest free trade agreement since the establishment of the World Trade Organisation in 1995.

The African Development Bank expects that the Continental Free Trade Area will stimulate intra-African trade by up to $35 billion per year, generating a 52% increase in trade by 2022 and a $10 billion decrease in imports from outside Africa. These efforts will continue to push up intra-Africa payment flows and its impact is being felt in the world as reflected in change in the use of currency.

How far could cryptocurrency go in challenging the status quo in Africa? Let us know what you think in the comments section below.

Images courtesy of Shutterstock

The Bitcoin universe is vast. So is Bitcoin.com. Check our Wiki, where you can learn everything you were afraid to ask. Or read our news coverage to stay up to date on the latest. Or delve into statistics on our helpful tools page.

The post US Dollar Losing Dominance as a Means for Settling Transactions in Africa appeared first on Bitcoin News.

Powered by WPeMatico