To kick-start the new week, we bring you news of bitcoin hitting a record low — for volatility, not price. There’s also been an altcoin breakout ahead of an impending Coinbase listing, a new metric for ranking cryptocurrencies and an obligatory new stablecoin story. It’s all covered in Monday’s edition of The Daily.

Also read: Rapper Soulja Boy Releases New Single Titled ‘Bitcoin’

Bitcoin Goes Nowhere

For the past two weeks, bitcoin core (BTC) has done precisely nothing price-wise, adhering closely to $6,600 territory. While behind the scenes there’s been plenty of development work going on, in the markets there’s been little cause for cheer or for gloom. So stable has BTC been, with its volatility hitting a 17-month low, that jokes have been circulating of bitcoin now constituting the world’s most decentralized stablecoin. Some have speculated that the lack of action is evidence of bitcoin maturing as an asset class.

For the past two weeks, bitcoin core (BTC) has done precisely nothing price-wise, adhering closely to $6,600 territory. While behind the scenes there’s been plenty of development work going on, in the markets there’s been little cause for cheer or for gloom. So stable has BTC been, with its volatility hitting a 17-month low, that jokes have been circulating of bitcoin now constituting the world’s most decentralized stablecoin. Some have speculated that the lack of action is evidence of bitcoin maturing as an asset class.

“This is a maturing market, so volatility should continue to decline,” observed Bloomberg Intelligence commodity strategist Mike McGlone. “When you have a new market, it will be highly volatile until it establishes itself. There are more participants, more derivatives, more ways of trading, hedging and arbitraging.” It’s too early to tell whether this interpretation is correct or whether BTC is simply taking a breather before sprinting to its next support level.

0x Climbs on Presumed Coinbase Listing

While BTC has remained stable, the same cannot be said of altcoins. 0x (ZRX) has been one of the best performers over the last 24 hours, up 12% after rumors of a Coinbase listing resurfaced. It’s been all but confirmed for months that the Ethereum-based relaying and governance token would be added to Coinbase at some stage, but screenshots showing 0x appearing on the site’s transactional reports section have convinced speculators that a listing is imminent.

PwC Teams Up With Cred to Launch Latest Stablecoin

News of another stablecoin is not news in itself, for such events have become daily occurrences in the crypto space. The entity behind the latest dollar-pegged token is of interest, however. Pricewaterhouse Coopers (PwC) is the world’s second-largest professional services firms, and ranked as a Big Four auditor, right behind Deloitte. It has collaborated with crypto-lending platform Cred to launch a new USD stablecoin.

News of another stablecoin is not news in itself, for such events have become daily occurrences in the crypto space. The entity behind the latest dollar-pegged token is of interest, however. Pricewaterhouse Coopers (PwC) is the world’s second-largest professional services firms, and ranked as a Big Four auditor, right behind Deloitte. It has collaborated with crypto-lending platform Cred to launch a new USD stablecoin.

“We are excited to work with Cred to help increase industry awareness regarding how the asset-backed digital token ecosystem can be secured and scaled on behalf of participants,” said PwC’s Grainne McNamara. “PwC’s commitment to the crypto community at large sends a very strong message to retail investors, mainstream financial services providers and the crypto enthusiasts that the world is moving toward decentralization, transparency and accountability in a system that will evolve beyond the need for trusted intermediaries,” added Cred co-founder Dan Schatt.

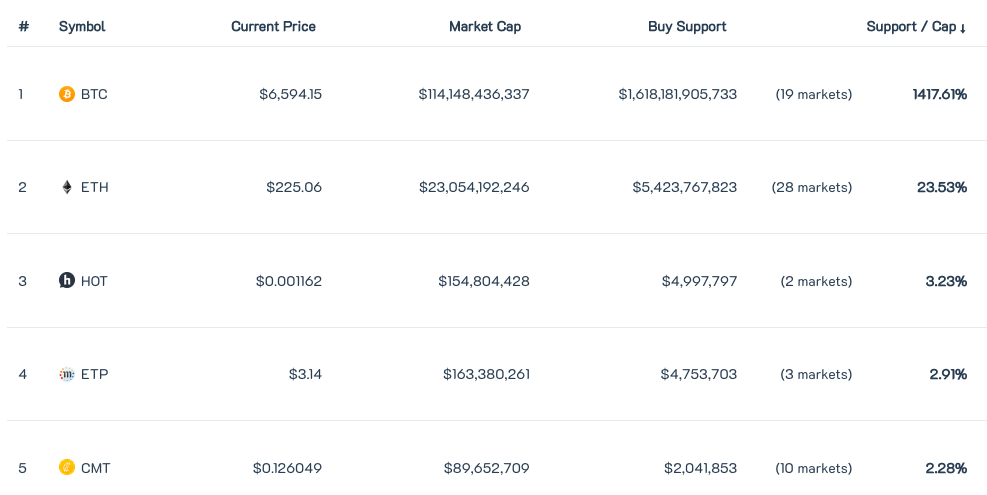

Liquidity Is the New Market Cap

Crypto enthusiasts have started talking about a new site that ranks cryptocurrencies by their liquidity rather than their total circulating supply. Coinmarketbook.cc examines the support levels for cryptocurrencies based on the percentage of their market cap that is set in buy orders on exchanges. It records BTC as being way out in front, with 1,417% of buy orders, based on the top 10 exchanges, followed by ether (ETH) at 23%. Thereafter, the next highest in-demand cryptocurrency has just 3% of buy orders set. Ripple (XRP), in comparison, appears way down the list, with just 0.21% liquidity. With the bulk of all ripples under lock and key at Ripple HQ, that’s not such a surprise.

What are your thoughts on today’s news tidbits as featured in The Daily? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post The Daily: Bitcoin’s Low Volatility and High Liquidity, PwC Backs Stablecoin appeared first on Bitcoin News.

Powered by WPeMatico