It’s been a pretty hectic week for cryptocurrency enthusiasts as the infamous Bitcoin Cash hash war has unfolded. Overall, the cryptocurrency economy has lost billions since our last markets update, with the entire market worth roughly $188 billion on Sunday, Nov. 18.

Also read: Cryptocurrency ATM Growth Spikes Exponentially to 4,000 Machines Worldwide

Riding Out the Lows

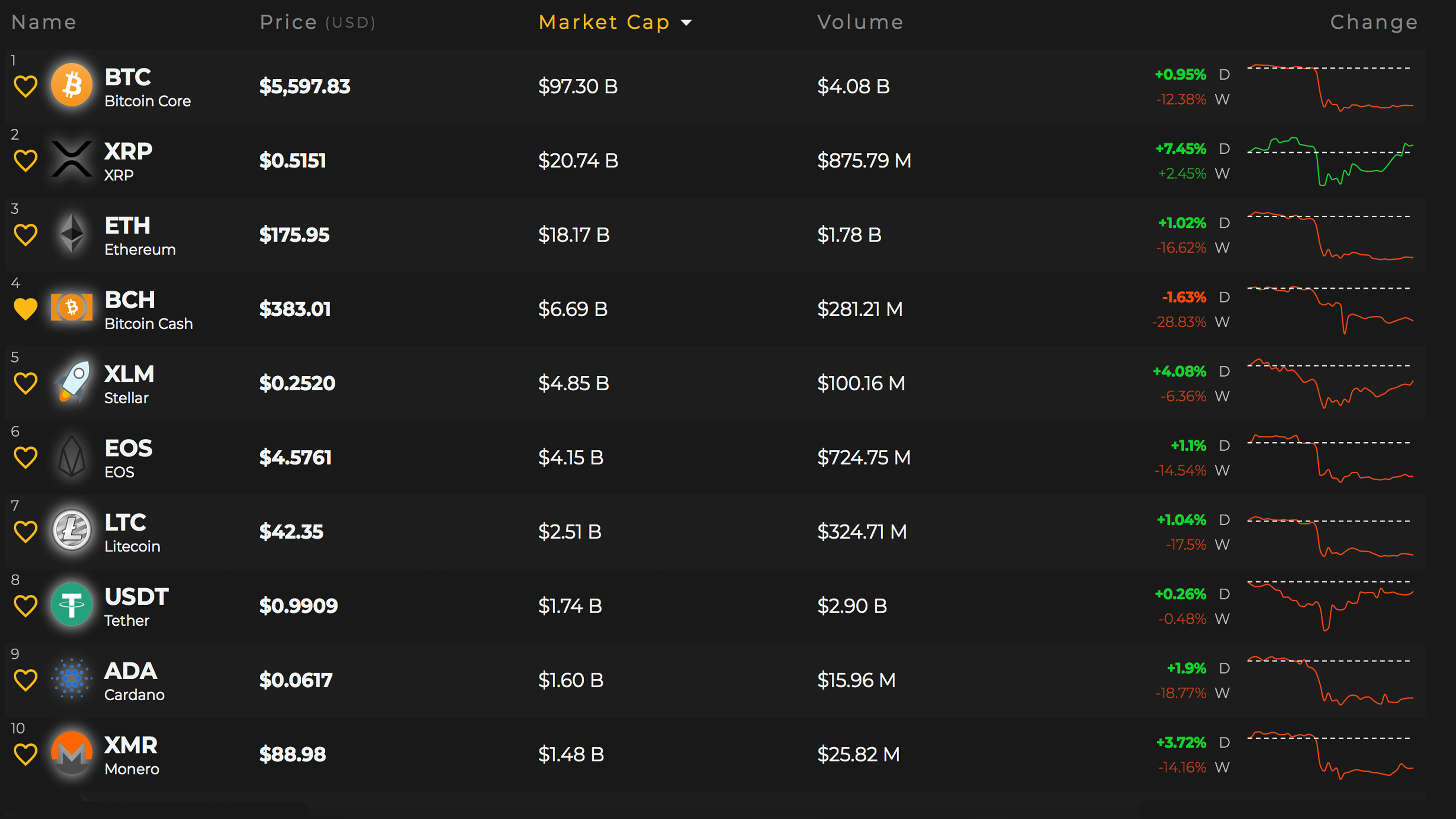

Most digital asset markets are seeing their lowest values in a year, leaving traders curious to see what happens next. The last week was filled with all kinds of craziness due to the Bitcoin Cash (BCH) split that took place on Nov. 15. Many digital asset enthusiasts believe the BCH fork possibly moved all the markets due to the economic activities used to fight the battle. Right now bitcoin core (BTC) is trading for $5,593 per BTC and has an overall market valuation of $97 billion. One thing many people didn’t notice during the hash war was that ripple (XRP) displaced ethereum (ETH) and took second place. The second largest market capitalization held by XRP is worth $20 billion and each ripple is being swapped for $0.50 today. Ethereum (ETH) prices are trading for $175 per coin and the market valuation is currently $18 billion. Lastly, the fifth position held by stellar (XLM) has a capitalization of around $4.8 billion and one XLM is trading for $0.25.

Bitcoin Cash (BCH) Market Action

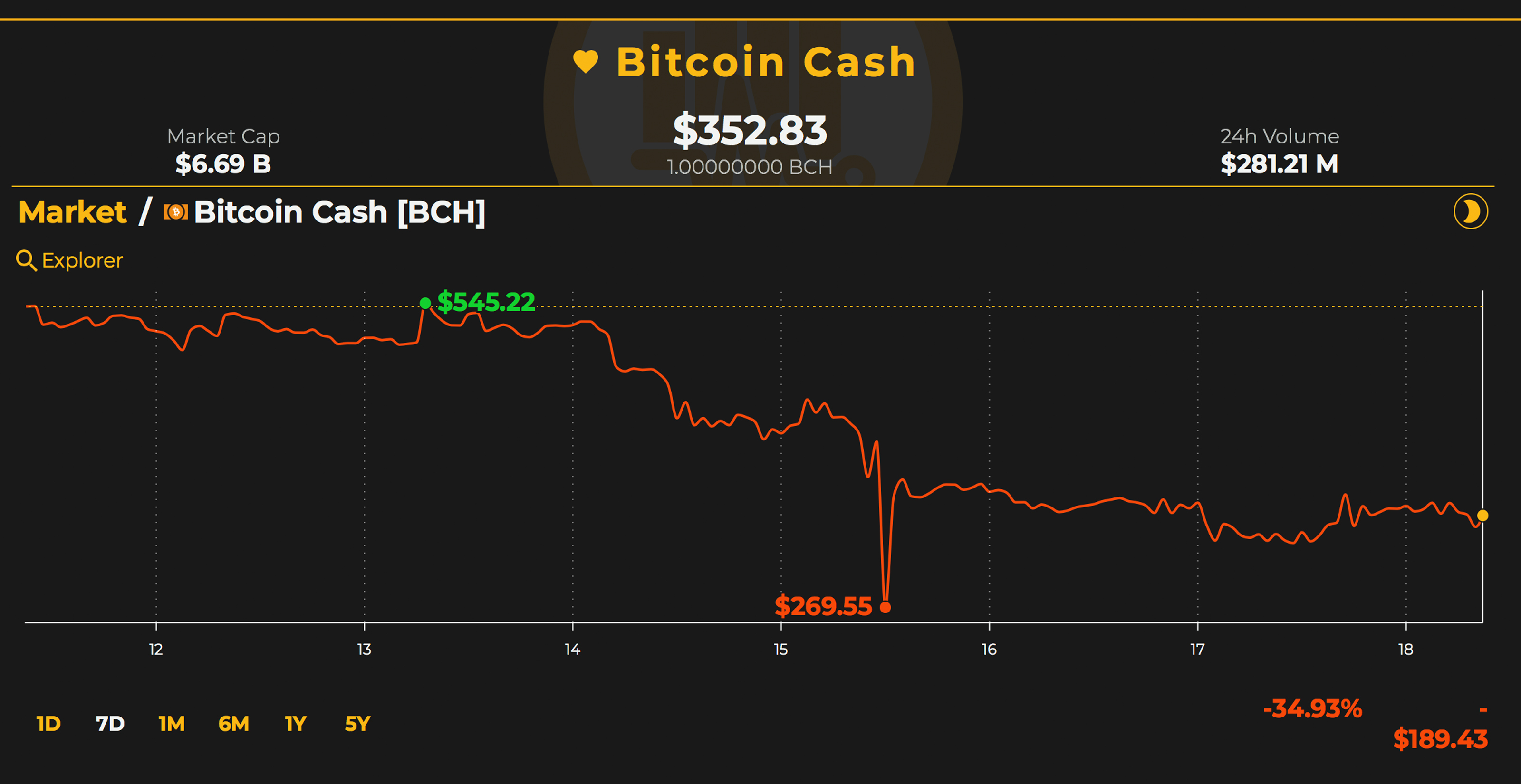

Bitcoin Cash (BCH) still holds the fourth position this weekend but the fork has depleted all the pre-fork money that went into the market in the weeks prior. BCH is trading for $381 right now which is a big improvement from its low of $269 on Nov. 15. Although it should be noted that a lot of large exchanges paused BCH trading over the last few days, but markets like Bittrex have recently opened. Because of the lack of trading vessels, BCH market pairs are quite interesting. Today ethereum (ETH) is dominating BCH pairs by 56% over the last 24 hours. This is followed by USDT (15%), BTC (14%), KRW (8.1%), and JPY (3.5%). Both the Korean won and Japanese yen have jumped considerably when it comes to BCH currency pairs.

BCH/USD Technical Indicators

Looking at charts from exchanges that are currently allowing trades like Bittrex and Voltaire shows BCH has been steadily climbing back up after being dragged down to the $269 low. The two Simple Moving Averages (SMA) are very close but the short term 100 SMA is still above the long-term 200 SMA trendline. This indicates the path toward the least resistance is the upside and when more exchanges open this will likely hold true for a little while but not for too long. At a price of $381, the 4-hour BCH Relative Strength Index (RSI) is still indicating oversold conditions at -23. Order books show a similar readout as the course toward $500 shows very little waves but there may be bumps after $450. On the backside, there are lots of foundations between the current vantage point and $300 with lots of pit stops.

The Verdict: Traders Patiently Waiting to Trade BCH Expect a Bunch of Market Action

Traders are waiting for more exchanges to open BCH markets up and when they do some believe the price could move wildly in any direction. Cryptocurrency proponents are also curious to what will happen to markets with the introduction of the new coin BSV, as most BCH supporters are confident exchanges will list the ABC chain as BCH. For instance, Kraken support has explained that the ABC chain will be given the BCH ticker, and Huobi Global emailed customers today stating:

BCH ABC, the longer chain, will be retained for the designation of BCH. And, we will be designating the SV version of BCH as BSV.

According to exchanges like Poloniex, which are trading BSV tokens at the moment, the price per BSV is around $99 USDC but is down 15% over the last 24 hours.

Where do you see the price of bitcoin cash and other coins headed from here? Let us know in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post Markets Update: Traders Expecting Major BCH Action When Exchanges Open appeared first on Bitcoin News.

Powered by WPeMatico