The Financial Services Agency of Japan has resolved to refer to cryptocurrencies as “crypto assets” in order to prevent confusion with legal tender. Also in The Daily, the Justice Ministry in Moscow has confirmed that it classifies digital coins as “other property.” Finally, according to a recent report, stablecoins have seen significant growth over the past few months.

Also read: Crashing Crypto Trader Shares Advice, Bitcoin Bandit Extradited

Japanese Regulator Renames Cryptocurrencies

Japan’s Financial Services Agency (FSA) has decided to call all cryptocurrencies “crypto assets,” the country’s leading daily Yomiuri Shimbun reported. The reasoning behind the decision is to help traders avoid confusing digital coins with legal tender recognized by the government in Tokyo. The regulator notes the price of many cryptos fluctuates wildly, there’s no evidence of value and it’s often unclear who is issuing them.

FCA’s advisory panel has produced a report this week in which its members claim the term “virtual currency” could cause misunderstanding, calling for its substitution. According to the document, the regulator’s recommendation is to revise all relevant Japanese laws and regulations. The revision is expected to cover different pieces of legislation such as the Payment and Services Law, which regulates the use of cryptocurrencies in the country.

The panel has also emphasized the need to establish a mechanism aimed at protecting users in events such as a “cash outflow,” as reported by Japan Times, the newspaper’s English language edition. To achieve that, the Financial Services Agency intends to oblige Japanese companies operating with crypto assets to implement strict management systems.

Cryptocurrency Is ‘Other Property’ Russian Ministry Says

Russia’s Justice Ministry has once again confirmed the property status of digital currencies. According to an official statement, “cryptocurrency can be classified as an object of civil rights and be subject to obligations.” The document has been issued by the ministry in response to a request for a legal interpretation of the term and reaffirms a previously declared stance.

Russia’s Justice Ministry has once again confirmed the property status of digital currencies. According to an official statement, “cryptocurrency can be classified as an object of civil rights and be subject to obligations.” The document has been issued by the ministry in response to a request for a legal interpretation of the term and reaffirms a previously declared stance.

The query has been filed by a group of traders who have been trying to attract the attention of Russian authorities to the case of the now inactive Wex crypto exchange, successor of the infamous BTC-e. They’ve published a copy of the statement in their Wex.nz Initiative Group Telegram channel. Wex users, who have been unable to withdraw their funds from the trading platform for months, have also filed complaints with the Interior Ministry in Moscow calling for an investigation.

The Ministry of Justice further explains that cryptocurrencies cannot be accepted as “electronic money” and notes that the holders of digital coins cannot raise claims against their issuers. Nevertheless, the department states that “cryptocurrency has a property value recognized by its turnover” and falls under the “other property” category as defined by Russian law, an opinion expressed earlier this year by Russia’s justice minister Alexander Konovalov.

To this day, cryptocurrencies remain unregulated in Russia, with several draft laws filed in parliament still under consideration. In its latest version, the main bill, “On Digital Financial Assets,” does not have the term “cryptocurrency” among its legal definitions. Members of the crypto community and industry organizations have called for its inclusion but according to a recent statement by the country’s deputy prime minister Maxim Akimov, authorities do not plan to make any significant amendments to the texts.

Stablecoins See Rapid Growth, Report Claims

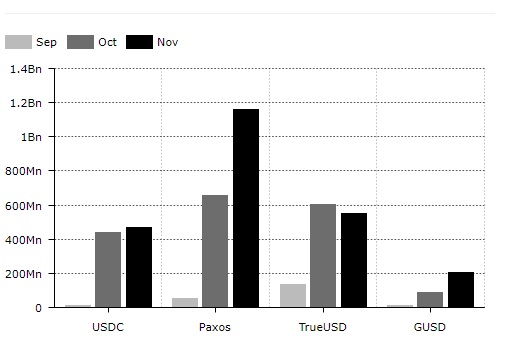

Stablecoins have enjoyed growing adoption in recent months, reveals a report published by research company Diar. The transaction volumes of four new stablecoins – USDC, TUSD, GUSD and PAX – have increased by 1,032 percent, the authors claim. In terms of value, the total volume of transactions with the new stablecoins reached $2.3 billion in November, and $5 billion for a three-month period.

have enjoyed growing adoption in recent months, reveals a report published by research company Diar. The transaction volumes of four new stablecoins – USDC, TUSD, GUSD and PAX – have increased by 1,032 percent, the authors claim. In terms of value, the total volume of transactions with the new stablecoins reached $2.3 billion in November, and $5 billion for a three-month period.

According to Diar, the paxos standard token (PAX), the most popular among these currencies, has attracted $93 million of volume. Its transactions volume is twice that of USD coin (USDC), a dollar-pegged crypto developed by San Francisco-headquartered digital asset exchange Coinbase in cooperation with crypto payments startup Circle. At the same time, the indicator has decreased for Trusttoken’s trueusd (TUSD) during the month of December.

Despite the significant drop in its capitalization last month, the most recognizable stablecoin, tether (USDT), is at the time of this writing the fourth largest digital currency by market capitalization.

What are your thoughts on today’s news tidbits? Tell us in the comments section.

Images courtesy of Shutterstock, Diar.

Make sure you do not miss any important Bitcoin-related news! Follow our news feed any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll down to the bottom of this page to subscribe). We’ve got daily, weekly and quarterly summaries in newsletter form. Bitcoin never sleeps. Neither do we.

The post The Daily: Japan Calls All Coins ‘Crypto Assets’, Russia Defines Cryptocurrency as Property appeared first on Bitcoin News.

Powered by WPeMatico