With the dust all but settled on 2018, it’s time to reflect on the year’s best and worst performing cryptocurrencies. In the Best category, there are few standout candidates, with all major altcoins deeply mired in the red. The Worst category, however, is stocked with shockers, including coins that need to multiply more than 100x in price to reach their former glory.

Also read: Spot Develops New Bitcoin and Cryptocurrency Portfolio App

Altcoins Have a Long Way to Go

The last seven days have been extremely positive for the cryptocurrency markets, with many digital assets up between 40 and 70 percent. Iota is up 67 percent, stratis 108 percent, and bitcoin cash 150 percent. It’s an impressive recovery, but it’s certainly not a reversal. Back in January, “expert” traders were throwing out wildly ambitious end of year targets that, amidst full bull market hysteria, may not have seemed that outlandish at the time. With 11 months of hindsight, however, it’s evident that calls for $500 neo and $20 ripple were total fantasy.

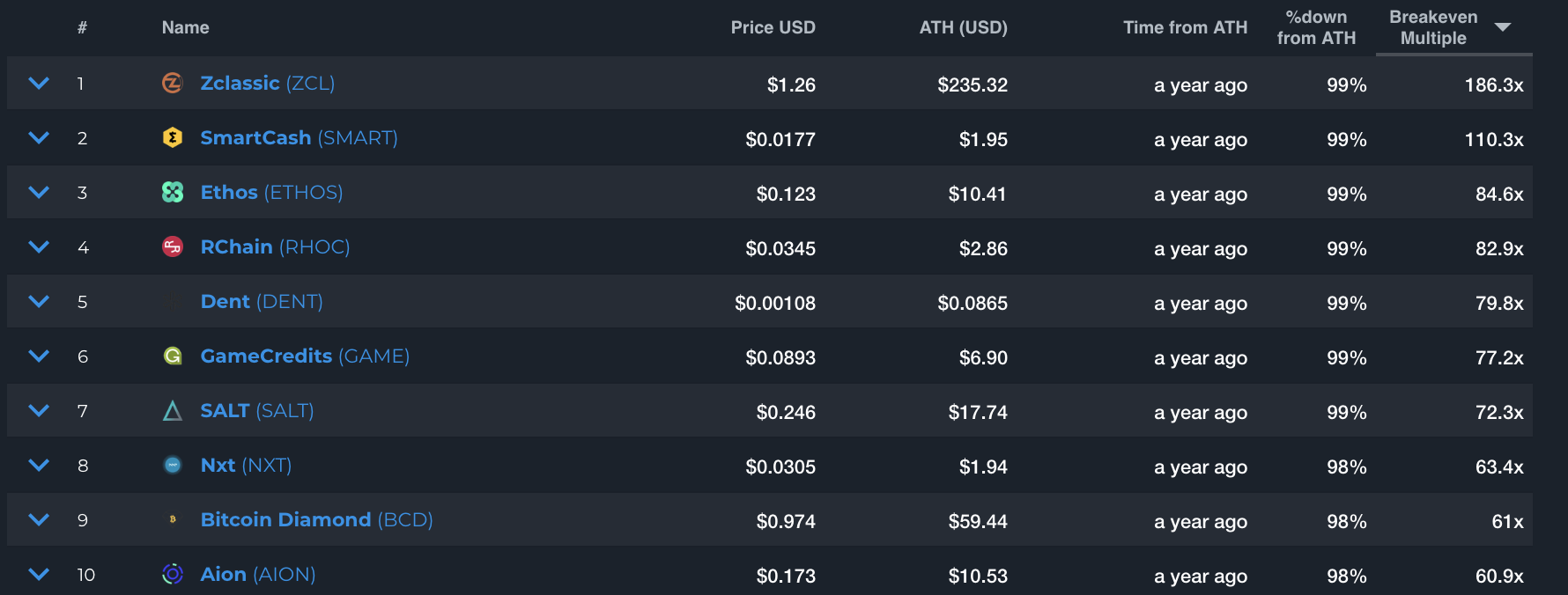

None of the altcoins that were tradable at the start of 2018 are on course to finish the year in the green, and it’s no coincidence that the coins that have lost the least, such as BSV, are also the newest, having been spared the bulk of the bloodletting that’s characterized 2018’s protracted bear market. An examination of the break-even multiple – i.e. the number of times an asset would need to double to reach its former all-time high – shows that many altcoins haven’t a snowball’s chance in hell of reaching the giddy heights they once occupied.

188x to Break Even

The worst performing altcoin, based on Messari’s break-even multiple, is zclassic (ZCL). One year ago, it was pumped to a high of $235 ahead of a fork to create bitcoin private (BTCP). Both coins have since performed disastrously, ZCL because it’s a dead coin and BTCP because it was always a shitcoin whose primary purpose was to enrich ZCL bagholders. Today, ZCL trades at $1.25 and would require a 188x to reach its former top. Down 97 percent from its own all-time high, BTCP would require a 33x.

Other altcoins that have a long way to climb include rchain (RHOC), a project that is close to bankruptcy, and which has a break-even multiple of 83x. Ethos requires an 85x and smartcash 113x. To place these losses in context, BTC is down 5x from its high one year ago. This puts it in the top 10 cryptocurrencies based on break-even multiple. Only a handful of altcoins that were available one year ago, such as mana, waves, binance coin, and link, have outperformed BTC this year.

While altcoins can provide significant profits, if realized in a bull market, holding onto them in a bear market can see them plummet to almost zero. It will be interesting to see whether crypto traders are as bullish with their price calls for 2019, or whether this year’s abject failure will have taught caution.

What are your thoughts on how cryptocurrencies will perform in 2019? Let us know in the comments section below.

Images courtesy of Shutterstock and Messari.

Need to calculate your bitcoin holdings? Check our tools section.

The post A Look at 2018’s Best and Worst Performing Cryptocurrencies appeared first on Bitcoin News.

Powered by WPeMatico