The cryptocurrency market has its very own long tail trend that sees the majority of all value flow to BTC, with altcoins left to fight for the scraps. With a $60 billion market cap and a dominance of 53 percent, BTC has ruled the market since day one. As altcoin investors endure the persistent pain of an ongoing bear market, they may be entitled to ask: is the long tail a long-term trend?

Also Read: Using Technical Indicators to Trade Crypto in 2019

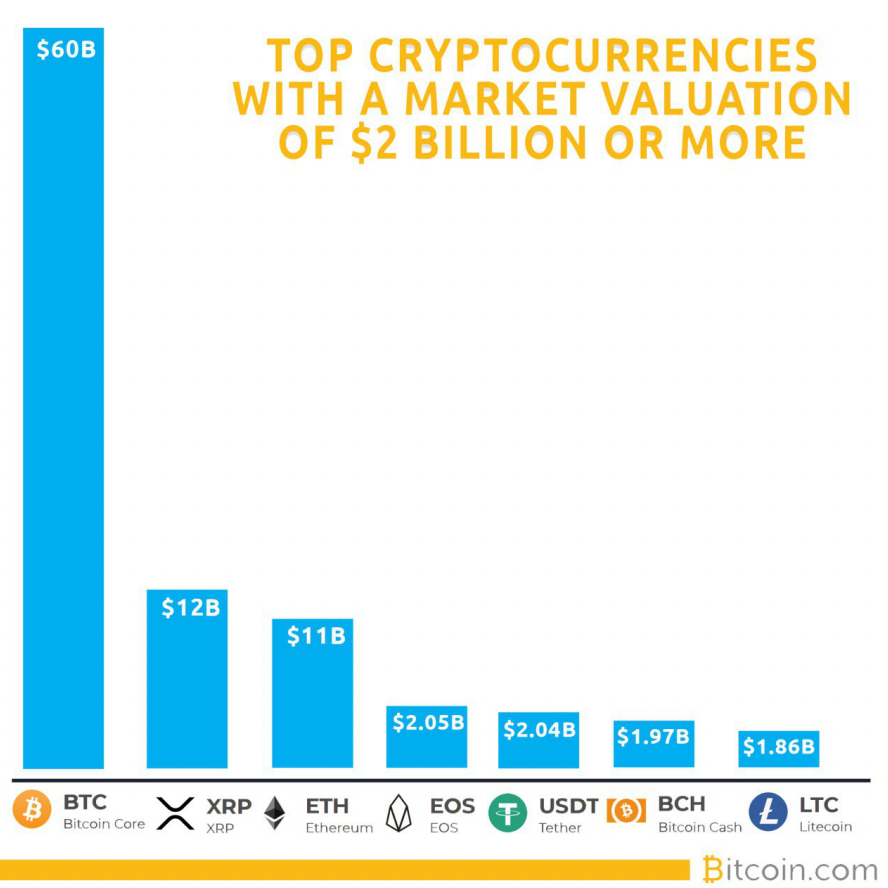

The Top 7 Cryptocurrencies By Market Cap

At the time of publication, the top seven cryptocurrencies by market cap are BTC at $60B, XRP at $12B, ETH at $11B, EOS at $2.05B, USDT at $2.04B, BCH at $1.97B and LTC at $1.86B.

Over the years there have been significant spikes and falls in bitcoin core’s decade-long dominance, but BTC has always retained the highest market cap. But this could yet change.

Based on ripple’s $12B market cap – a figure which is hotly disputed – it would it take a 5x for second-in-line XRP to dethrone BTC. Currently, bitcoin core is sitting pretty and leading the way by a considerable margin, just as it has done for the majority of its history. It is also listed on the most exchanges, making the mother coin tough to take down.

Market Cap Is a Poor Metric

According to crypto analysts, market capitalization is a poor metric for measuring the value of the cryptocurrency market. Mati Greenspan of Etoro told news.Bitcoin.com: “Trying to measure the value of a crypto network using the market cap is like evaluating the health of a person based on body weight.”

Is it even possible to predict which cryptocurrency might one day overtake BTC? Hugo May, investment analyst at Invictus Capital, said: “I am wary of predicting which of these sides will eventually prevail. It is often said that ‘hindsight is 20/20’ in terms of vision, and it is likely we will look back one day amazed at how seemingly obvious the natural progression of adoption was. But for now, we can merely look to where the users and development resources are migrating.”

Crypto Market Is Packed With Opinions

May stressed that the crypto space is packed with opinions regarding future asset prices and technical developments. “A very contentious dispute exists between the supporters of maximalism and those that lean to multi-tokenism,” he noted. “The maximalists, often referred to as bitcoin maximalists, generally believe that the genesis blockchain would serve all of the blockchain needs and that the bitcoin asset would regulate all appropriate value transfer.”

May stressed that the crypto space is packed with opinions regarding future asset prices and technical developments. “A very contentious dispute exists between the supporters of maximalism and those that lean to multi-tokenism,” he noted. “The maximalists, often referred to as bitcoin maximalists, generally believe that the genesis blockchain would serve all of the blockchain needs and that the bitcoin asset would regulate all appropriate value transfer.”

The concept of multi-tokenism envisions a network of networks, which comprise small applications that connect with large protocols at various junctures. May explained the movement has come about through the creation of Turing complete blockchains, specifically Ethereum, which today hosts a magnitude of tokens and decentralized applications.

May noted how, compared to Ethereum, the traditional first-generation blockchains such as Bitcoin Core and Litecoin tend to have smaller developer communities, which are comprised of highly competent developers who consistently develop the protocols. “Some of these developers even get paid salaries to produce updated code and advancements. The vast majority of blockchain engineers and IT professionals that enter the space do not work for Blockstream, the largest [BTC] blockchain development company [but] are involved with smaller endeavors,” he explained.

Most developers are focused on so-called second generation blockchains where interoperability is one of the technical challenges that currently has the highest resource allocation within the industry. May explained that if these interconnected networks and tokens become migratable and the establishment of some development standards is successful, it is plausible that we could see a multi-token ecosystem in the future. The experience, he added, would be akin to visiting a grocery store, with several producers equally connected at the UX layer.

“In terms of value transfer and applications, the backend is built by a magnitude of projects that interact and communicate with each other, but the user in the front experiences a seamless and simple process when engaging the interface. The long tail thesis is only possible if decentralized … [projects] develop with some sort of standard in terms of interoperability,” said May.

Lesser Known Cryptos Likened to Dodgy Watches

The crypto market downturn has seen many casualties. Stefan Neagu, the co-founder of Persona, told news.Bitcoin.com: “I believe that what we see, and what we have right now in the cryptocurrencies market, is similar to what we see in the movies when a guy opens up his jacket and on both sides, you can pick a shiny new watch, whichever one you want. But just like in the movies, in which the buyer will have no guarantee that the watch will function properly or that it’s an original not a counterfeit, the same occurs in crypto. You don’t have much information about the project or a team’s ability to deliver, you have no idea about how successful or not that project will be.”

The crypto market downturn has seen many casualties. Stefan Neagu, the co-founder of Persona, told news.Bitcoin.com: “I believe that what we see, and what we have right now in the cryptocurrencies market, is similar to what we see in the movies when a guy opens up his jacket and on both sides, you can pick a shiny new watch, whichever one you want. But just like in the movies, in which the buyer will have no guarantee that the watch will function properly or that it’s an original not a counterfeit, the same occurs in crypto. You don’t have much information about the project or a team’s ability to deliver, you have no idea about how successful or not that project will be.”

Neague explained that it makes more sense to have a long tail on cryptocurrencies where one coin performs a specific purpose. “What would make them more valuable, in the sense of raiding their utility, is a way to interconnect these long tail tokens, so a user of blockchain X is not stuck in that blockchain but has the ability to get outside the borders and perform whatever action it wants in another blockchain.”

As the crypto market evolves, only a handful of digital coins currently near the top of the market cap charts are likely to survive. Whatever the outcome, it’s likely that the long tail trend will continue, with BTC leading the charge and the chasing pack coming in a distant second.

Will BTC ever be dethroned as the dominant cryptocurrency? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Analysis: Will the Cryptocurrency Market’s Long Tail Trend Ever End? appeared first on Bitcoin News.

Powered by WPeMatico