With the beta launch of crypto and fiat-enabled business accounts, crypto payments platform Wirex has taken a major step toward mainstream business acceptance. Using a cryptocurrency business account will eliminate the need to convert to fiat unnecessarily during inter-company fund transfers, validate crypto businesses in the wider marketplace, and offer some of the benefits traditional bank accounts provide business users.

Also read: Switzerland Shows the Way: Bank First to Offer Crypto Business Accounts

European Beta of Crypto Business Accounts

For the duration of the desktop-only beta, the first round of invitation will be open only to business customers within the European Economic Area, a total of 30 European states, and Switzerland. Wirex told news.Bitcoin.com that it will roll out access to its business accounts in other regions, including APAC and North America, later this year.

Multi-Currency Support and Vanity Account Feature

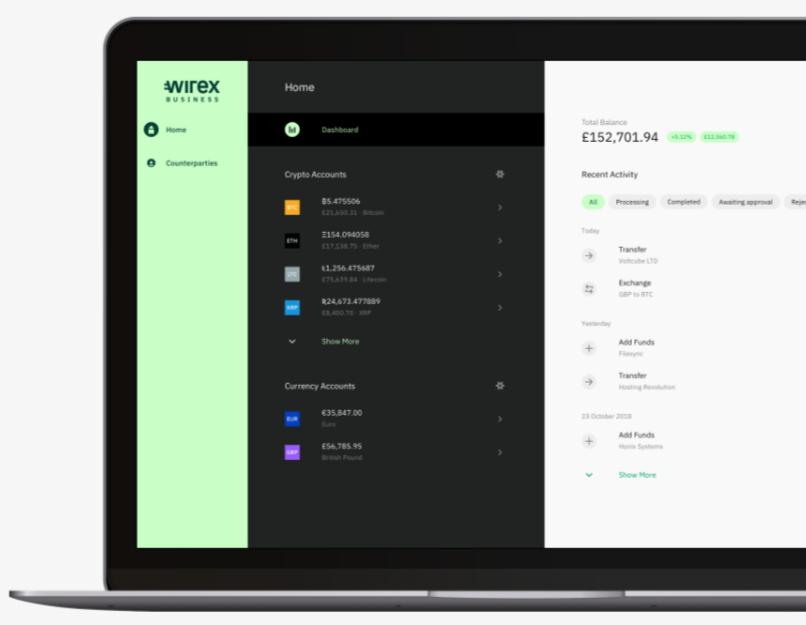

Wirex’ new business account allows clients to hold up to six multi-currency fiat and crypto accounts within a single account. These currencies include two fiat currencies (USD and GBP) and, for the moment, four cryptocurrencies (BTC, ETH, LTC, and XRP). In future, four additional cryptocurrencies and 13 fiat remaining fiat currencies (EUR, HKD, JPY, SGD, AUD, CAD, NZD, CHF, CZK, HUF, MXN, PLN, and SEK) will be added.

Users are able to register business accounts in the name of their company’s legally registered entity, a landmark move in terms of lending crypto businesses a greater air of legitimacy and allowing them to stand shoulder-to-shoulder with traditional entities in the business world. Payments made will reflect the name of the cryptocurrency’s legal entity on recipients’ bank statements.

Fees and Security

Easing the high fees charged by traditional banks, business account users will have “unconditional access” to OTC and interbank rates when exchanging, paying, or receiving crypto or fiat. Additionally, monies held will be able to move fast across international borders. Business accounts offer a range of options, enabling payments using SEPA, Swift, and blockchain.

User funds, similar to Wirex personal accounts, are stored in segregated, multi-signature cold-storage supported by 2FA and 256-bit AES encryption, and business accounts sport robust permission controls, allowing account holders to set and manage roles and permission on a per-account basis.

Edging Closer to Mainstream Adoption

A handful of clients have already been onboarded to Wirex’ business accounts service including a selection of crypto startups, software providers, retailers, and financial institutions. Additionally, Makerdai is joining its list of business clients.

Wirex, headquartered in London, is one of only three crypto-fiat companies based out of Europe to hold an e-money licence from the UK’s Financial Conduct Authority (FCA). In communication with news.Bitcoin.com, Wirex CEO Dmitry Lazarichev said that the move is a calculated one to achieve Wirex’ mission, namely to further the crypto industry:

We believe our platform will be very useful for startups involved in blockchain and digital assets. Our long term vision is to provide solutions for merchants so they can start accept payments in digital assets and manage those efficiently. We started building our B2B platform because we identified how difficult it is to get access to banking infrastructure for startups in general and especially blockchain-focused ones to perform payments for daily routine operations.

What effect do you think crypto business accounts will have on the industry? Let us know in the comments below.

Images courtesy of Shutterstock and Wirex.

Need to calculate your bitcoin holdings? Check our tools section.

The post Wirex Introduces Global Crypto Accounts for Businesses appeared first on Bitcoin News.

Powered by WPeMatico