In the time it takes you to read this sentence, $850 will have been lost to cryptocurrency scams. In the time it takes to complete this article, that figure will have risen to $17,000. Phishing; fraud; theft; hacking; it’s all rife. In the first two months of 2018, there were 22 separate scams involving thefts of $400,000 or more. Put it all together and that equates to an average of $9.1 million a day. Oh, and that doesn’t include 2018’s outliers – Coincheck, Bitconnect, and Bitgrail. Otherwise, the total would actually stand at $23 million a day.

Also read: 132 Customers File Class Action Lawsuit Against Coincheck

There’s a Scammer Born Every Minute

Welcome to 2018, where $1.36 billion has already been stolen by cryptocurrency scammers, and we’re only 59 days into the year. Even when the big three of Coincheck, Bitconnect, and Bitgrail are removed from the equation, that figure stands at a hefty $542 million. If that trend were to continue for the remainder of the year, hackers, scammers, and fraudsters would pocket $3.25 billion, which is the GDP of a small African nation. That figure sounds damning, and is one that cryptocurrency exponents will be swift to seize upon.

A little context then. One of the best things about the cryptocurrency space is its transparency. This is a principle which doesn’t just apply to blockchains – it applies to the entire ecosystem. Publications such as news.Bitcoin.com, together with many more, while happy to report positive developments, have no qualms about disclosing the negative side of cryptocurrency. The good, the bad, and the ugly are all publicized, firstly because it’s relevant, and secondly because this knowledge helps readers defend themselves against similar scams.

It would be great to see the number of cryptocurrency thefts drop to $4 million a day, then $1 million and eventually zero, but realistically that’s not going to happen. The best that can be hoped for is a reduction in the amount lost to scammers. You don’t have to be smart to trade cryptocurrencies, but doing so will almost certainly make you smarter. The average crypto holder is more aware of security threats, both cyber and physical, and more inclined to question everything. You might one day sell your bitcoin, but you’re unlikely to ever disable your 2FA. That’s what a good grounding in the crypto trenches does.

Breaking Down 2018’s Biggest Scams

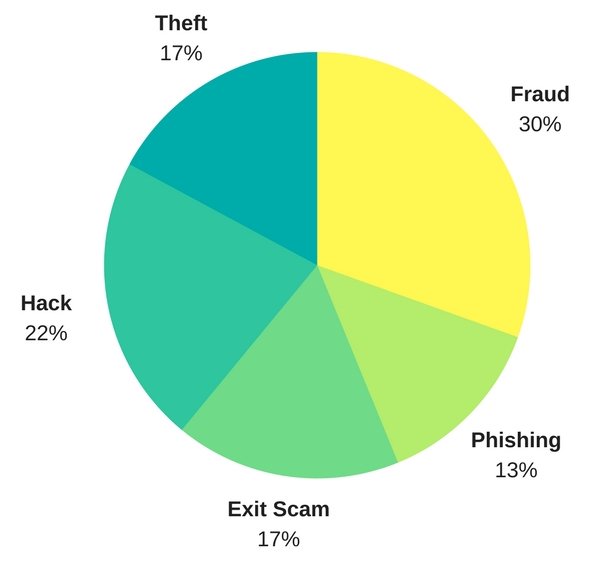

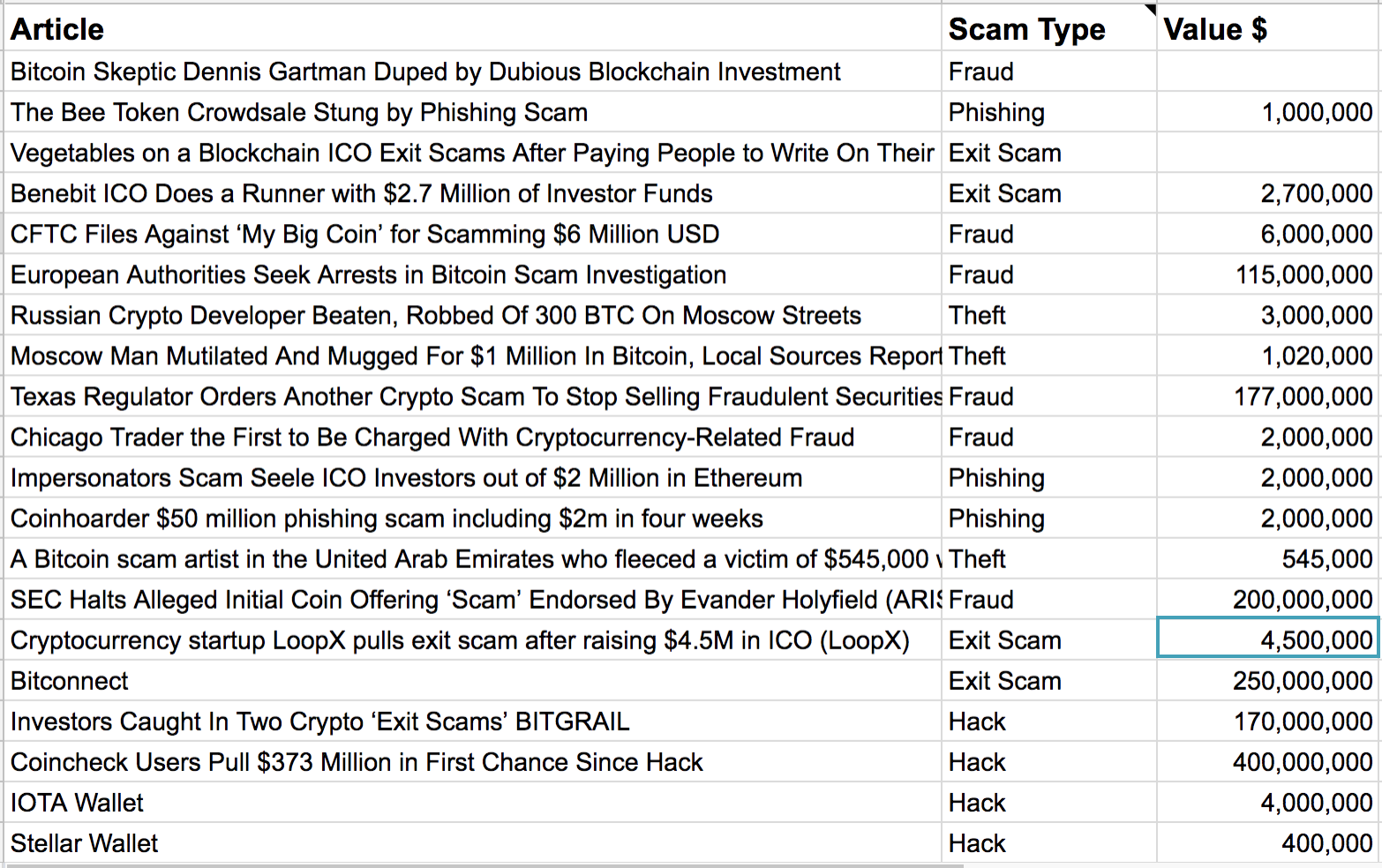

News.bitcoin.com profiled every major cryptocurrency scam to have been reported in the first two months of 2018. Incidents which occurred last year but were only discovered in 2018 were included, but conservative valuations were taken to avoid over-inflating the figures. Bitconnect, for example, was included, because the exit scam occurred this year, but the scheme was valued at $250 million rather than the maximum possible $1.5 billion, which seems unrealistic. Similarly, the Arise ICO scam was recorded at a lower figure than the $600 million reported. In some cases, it was impossible to obtain a valuation, and so that field was left blank rather than hazard a guess. Because hacks such as the Coincheck incident are so large, they have been recorded here, but omitted from the daily average.

The truth is, it’s impossible to put a precise figure on the amount of money lost to crypto scammers on a daily basis. With a minimum reporting threshold of $400k, none of the countless “micro-scams” perpetrated on Twitter and Telegram every day make the list. The purpose of establishing a ballpark figure for crypto scams is because it sets a baseline that can be tracked. News.bitcoin.com will continue to monitor all such incidents, and will publish an update at the end of the year. This will reveal whether the spate of scams and their average daily cost has risen or fallen with time.

A net reduction could signal that cryptocurrency platforms and their users have gotten wiser to common attack vectors. Should bitcoin go on another bull run, as it did in late 2017, however, it would push up the average value of each successful heist, and make even the lowest hanging fruit an attractive proposition to thieves. Behind every sophisticated heist is often a simple measure that could have been taken to prevent it. Compared to the total valuation and daily trading volume of the cryptocurrency markets, the incidents reported here are but a drop in the ocean. Highlighting them, however, is the first step towards preventing history from repeating itself.

Do you think cryptocurrency scams are inevitable, or do you think through education and better security they can be reduced? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post $9 Million a Day Is Lost in Cryptocurrency Scams appeared first on Bitcoin News.

Powered by WPeMatico