Digital asset markets have been gathering some gains during the last few days and tokens like stablecoins have seen massive demand since the start of the market carnage. Alongside stablecoins, gold-backed digital assets like Tether Gold, Pax Gold, and Digix Gold have seen tremendous trade volumes as well. In fact, cryptocurrencies that claim to be backed by gold are selling for 1-5% above gold’s .999 per Troy ounce spot price.

Also read: Hyperbitcoinization: Visions of Bitcoin Fueling the Post Covid-19 Shadow Economy

Gold-Backed Crypto Assets Shine

Crypto assets are doing well on Tuesday following the rebound equity markets saw the day prior. In addition to digital currency markets, precious metals have been rising on April 7 as well. At the time of publication, the price of gold per Troy ounce is hovering around $1,654. Gold has been considered a safe-haven asset during these uncertain economic times that were sparked by the covid-19 outbreak. Similarly to crypto assets, gold prices took a hit on March 12 but gold values have regained those losses since then. There’s been a lot of demand for gold and reports have noted during the last two weeks that gold dealers have seen “big shortages of small bars and gold coins.”

“People want to buy, not to sell gold,” Mark O’Byrne, the founder of the firm Goldcore told the press on April 2. “We have a buyers’ waiting list and we emailed our clients seeing who wished to sell their gold. At this time there are roughly only one or two sellers for every 99 buyers,” O’Byrne added.

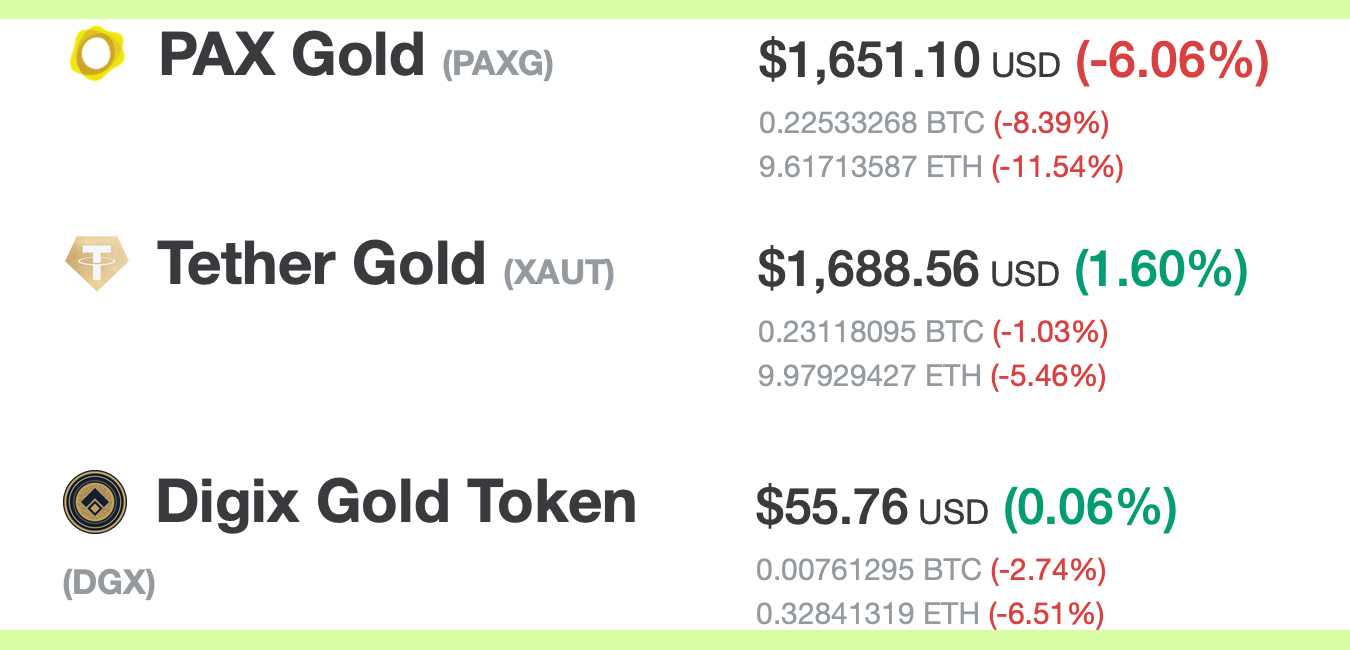

The demand for gold assets has found its way into the cryptocurrency industry as well. The number of projects that claim their tokens are backed by physical gold has seen increased buying and premiums in the last few weeks. Coins like Tether Gold (XAUT) and Digix Gold (DGX) are swapping for 1-5% above gold’s .999 per Troy ounce spot price. For instance, the XAUT token is selling for 1.5% more than spot prices on Tuesday. According to the firm Tether Limited, a full XAUT “represents one troy fine ounce of gold on a London Good Delivery bar.” With the current gold spot price trading for $1,654, a single XAUT is trading for $1,679 to $1,688 per token depending on the exchange used.

Digix Tokens Close to 5% Above Spot Gold

Then there’s the Ethereum-based gold project Digix with its DGX coin, a token that’s allegedly redeemable for 1 gram of gold per DGX. If one was to obtain a hair over 31 DGX on Tuesday, April 7, they would spend 4.47% more than gold’s spot price at $1,728 for the lot of 31.1 tokens. Pax Gold today is trading for a touch less than the spot price of gold as each PAXG is swapping for $1,651 per token. The company Pax Global claims that “every PAX Gold token is backed by an ounce of allocated gold.” Users who hold PAXG can utilize a tool that looks up the serial number and information about the physical gold’s source.

A number of other digital assets that allege to have physical gold backing are doing far better than the spot price of physical gold bars. Of course, obtaining real bars and coins made of gold are also carrying similar premiums. Local gold dealers are desperately contacting wholesalers to get their hands on smaller bars and coinage. While retail buyers are allegedly spending 10-15% more to get their hands on physical gold, it seems crypto tokens backed by gold are seeing similar premiums.

What do you think about the demand for tokens that claim to be backed by physical gold? Let us know in the comments below.

The post 5% Over Spot: Gold-Backed Tokens Tether Gold and Digix Sell for Higher Premiums appeared first on Bitcoin News.

Powered by WPeMatico