Having recently had to report over 13,000 of its clients to the US Internal Revenue Service (IRS), making it easier to handle tax reporting is a must for Coinbase. The company has launched a tax calculator, but it will not be of much use for many of its clients including those who transacted with GDAX, stored cryptocurrency on a hardware wallet, or invested in an ICO.

Also Read: Nasdaq-Listed Marathon Begins Bitcoin Mining Operations, Stock Up 32%

Easier Tax Reporting

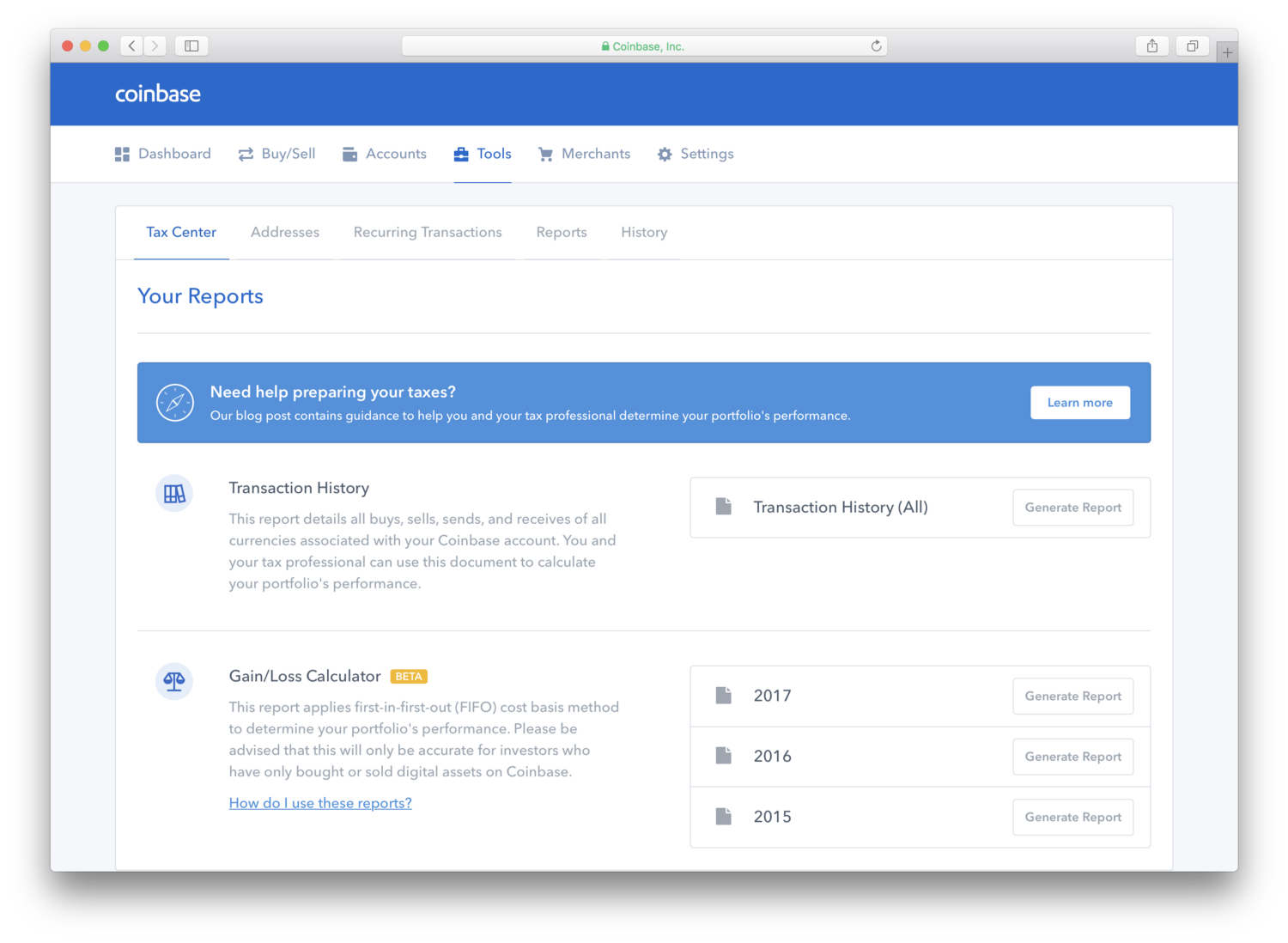

San Francisco-based cryptocurrency exchange Coinbase has announced updated tax tools, now available to make reporting easier for its traders. The services are not designed for automatic reporting but rather as a method to help clients and their real tax professionals by simplifying the work.

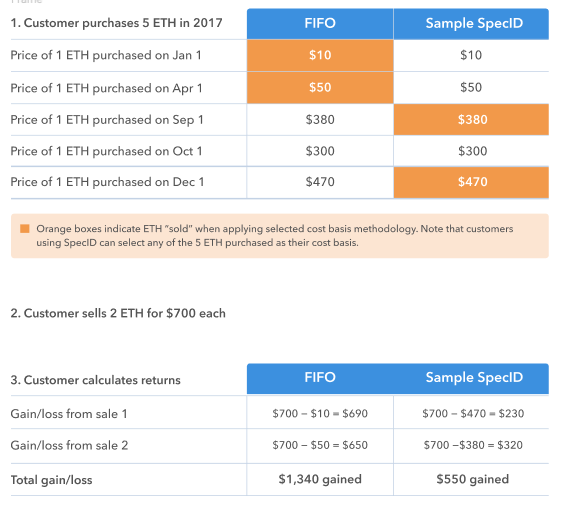

Traders can get a complete view of all digital asset transactions by generating a single report with all buys, sells, sends, and receives of all currencies associated with their Coinbase account. This report provides a cost basis for all purchases and proceeds for all sales, including exchange fees. This is necessary to determine gains or losses, calculated by subtracting the cost basis from the proceeds for each individual trade. Lacking a clear standard guidance from the IRS tax professionals can be creative, but two approaches are common: First in first out (FIFO) and Specific Identification (SpecID).

The company reminds clients that “In order to create a complete view of your digital asset investments, you will need to download similar reports from all other exchanges you have used.” But if you haven’t used any other exchanges, Coinbase has an extra tool just for you.

Coinbase-Only Crypto Tax Calculator

For cryptocurrency traders who have only bought or sold on Coinbase, the excahnge also now offers a new tool that automatically calculates gains or losses based on a FIFO accounting method. The company says that this tool provides a preliminary gain/loss calculation to assist its customers, but “should not be used as official tax documentation without validating the results with your tax professional.”

The company warns that you can not use this tool if you have: Bought or sold digital assets on another exchange; Sent or received digital assets from a non-Coinbase wallet; Sent or received digital assets from another exchange (including GDAX); Stored digital assets on an external storage device (i.e., Trezor, Ledger, etc.); Participated in an ICO; Previously used a method other than FIFO to determine your gains/losses on digital asset investments.

How do you calculate your bitcoin trading taxes? Share your thoughts in the comments section below!

Images courtesy of Shutterstock, Coinbase.

Do you like to research and read about Bitcoin technology? Check out Bitcoin.com’s Wiki page for an in-depth look at Bitcoin’s innovative technology and interesting history.

The post Coinbase Launches Cryptocurrency Trading Tax Calculator appeared first on Bitcoin News.

Powered by WPeMatico