The arrival of newly created ASICs and a large decrease in mining profitability has had an impact on the GPU mining market. Nvidia expects the demand for graphics cards to decrease over the course of this year as a result. What could this mean for the GPU market today?

The Rise of ASIC Miners

The cryptocurrency mining industry has seen significant changes through increases in miner counts and subsequent decreases in mining profitability over recent months.

The latest cryptocurrency price boom attracted a large number of new investors and exponentially increased the difficulty of many mining algorithms. Additionally, many ASIC manufacturers announced plans for new mining machines, which will disrupt the GPU mining industry.

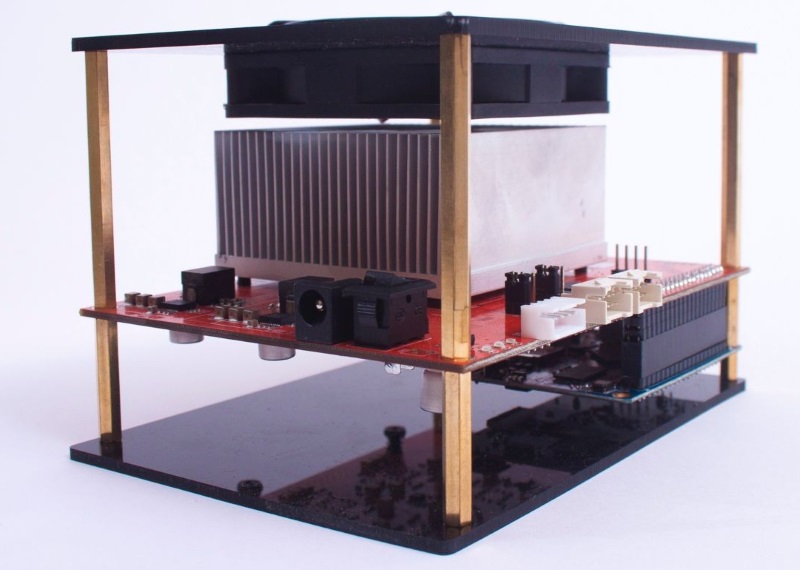

ASIC computers are specialized computers built to mine cryptocurrencies on specific algorithms. These ASIC miners were traditionally only built for certain algorithms, such as Bitcoin’s SHA-256 or Litecoin’s Scrypt.

However, some ASIC manufacturers, such as Baikal, have announced that they are planning on building ASICs for alternative algorithms. Some of these include Cryptonite, the algorithm used by coins like Monero and Electroneum, and a rumored ASIC manufactured by Bitmain for Ethereum and Ethereum-based tokens as well. However, Ethereum developers still state that Ethereum is ASIC resistant and that they will do their best to make sure that it stays that way.

Ethereum is one of the most popular GPU mineable coins as it is easy to mine and is widely accessible. However, with the rumored news of the Ethereum ASIC, miners may need to turn to other coins to produce a good profit.

Many coins often lack the support for graphics card miners as many coins are not ASIC resistant and their systems have become overrun with ASIC miners. There is a chance that the graphics card mining market may begin to fall apart in the upcoming months.

ASICs are often the topic of debate as some suggest that they promote the centralization of blockchain networks and allow for corporations to take control of mining operations. With the recent announcement of the Cryptonite ASIC built by Baikal, Monero has decided to use a hard fork to combat ASIC use. This move was well received by the Monero and GPU mining communities as it allows for retail miners to continue their active involvement in the Monero community.

The manufacturer of the recently announced Cryptonite ASIC, Baikal, has not had the best history in the cryptocurrency space. They may be ‘all talk, no game’ meaning that they may not be able to deliver with their Cryptonite ASIC. They may not have the capability to mass produce this product therefore making this foray into the Cryptonite market, irrelevant. However, seeing that Monero developers still plan to hard fork Monero, shows that they are still wary of the arrival of Cryptonite ASICS.

So what makes ASICs so great compared to traditional graphics cards?

ASIC miners provide consumers with an increased computational power per watt and price with ASICs outperforming graphics cards by many magnitudes on multiple levels. There was a time where you could mine Bitcoin with any old computer. Now, you can only make a profit specifically with ASIC miners, which quickly took over the CPU and GPU Bitcoin mining scene.

What Changes Can Be Made To Decrease ASIC Impact?

Nvidia, the world’s largest graphics card supplier, has enacted plans which are set to reduce sales of GPUs for mining operations. Sources say that Nvidia is taking steps to reverse has taken form in restrictions and advisories placed on Nvidia-authorized sellers. Nvidia wants retail stores to end the act of promoting GPUs to be used in mining systems sources state. Additionally, Nvidia has decided to slow the creation of new graphics processing architectures in an attempt to slow the use of their graphics cards in mining systems.

There is a high probability that these sources are citing exaggerated or false information as it is unlikely that Nvidia would seek to undermine their own profits. On the other hand, Nvidia’s executives are cognizant of the fact that mining operations made some previous Nvidia customers to lose trust in their company. So it would only make sense that they are planning to take some action against the mining industry to restore trust with PC enthusiasts.

The graphics card shortage caused by the growth of the mining market caused many computer enthusiasts and scientists to become enraged due to unsustainable prices. The recent craze around consumer-grade GPUs has caused prices to inflate by over 50% over the recent year and is seeing no signs of stopping.

Astronomer Aaron Parson said:

We designed the whole thing (telescope) , priced it all out, and then suddenly Bitcoin showed up in the headlines and overnight the price of GPUs doubled. And within a week, they were all gone, which was sort of a pain.

Scientists have found it hard to gain access to graphics processing by the lack of GPUs available. Graphical processing is a key aspect of running experiments to expand scientific knowledge.

In addition, the increase in GPU prices rightfully made many computer enthusiasts to have an adverse reception to the mining of cryptocurrencies. However, with recent announcements concerning ASICs and the changes Nvidia are going to make, prices for GPUs should soon return to more manageable levels.

Mining through proof-of-work algorithms is still an important part of the many cryptocurrency networks and provides blockchains with their biggest source of security and immutability. A loss of mining power would certainly have a negative impact on the cryptocurrency sector.

What are your opinions on ASIC miners? Do you think that ASIC miners benefit the space and the decentralized aspect of cryptocurrencies? Tell us in the comments below!

Images courtesy of Canaan, GeForce, Baikal, Pixabay

The post Is GPU-Based Cryptocurrency Mining at Risk of Extinction? appeared first on Bitcoinist.com.

Powered by WPeMatico