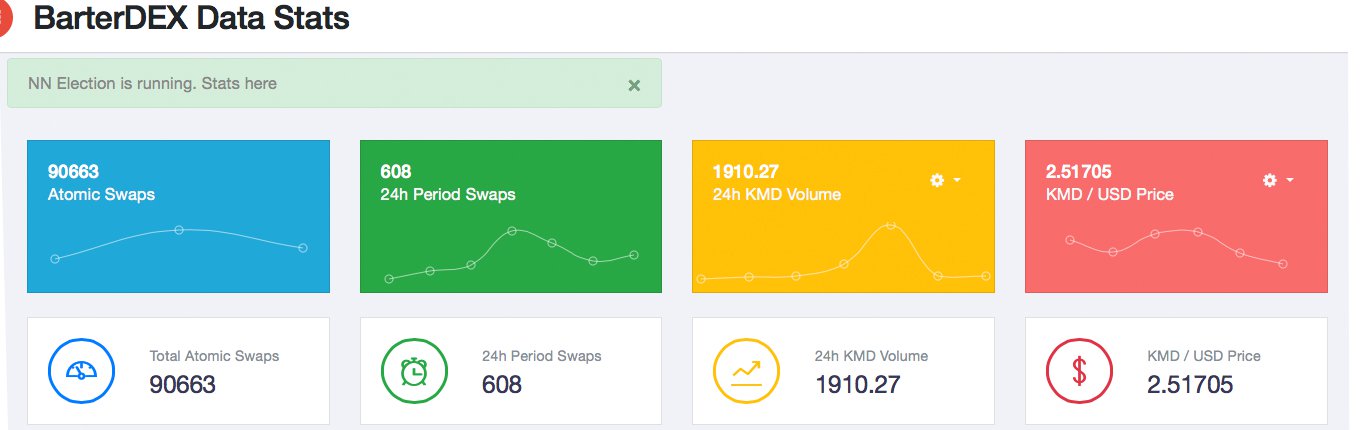

The method of atomic swap trading within the cryptocurrency space has become a hot subject, and a few software development teams have been working on this type of cross-chain technology. One group is Komodo, the creators of the decentralized exchange ‘Barterdex.’ The trading platform reveals a total of 90,663 successful atomic swaps have been executed using Barterdex, so news.Bitcoin.com decided to give the user interface and software a test.

Also Read: Cobinhood Delists Six Tokens Susceptible to Pump and Dump, Limits Tether Pairs

Test Driving the Komodo Platform Barterdex

A few weeks ago in Mexico news.Bitcoin.com had a chance to see a walkthrough of an atomic swap between bitcoin cash and two other cryptocurrencies. A Komodo developer showed us the ropes of how to trade and how the platform’s decentralized order book works. When returning from Mexico news.Bitcoin.com decided to see how easy it was to use without any guidance so our readers can get an in-depth look at this technology.

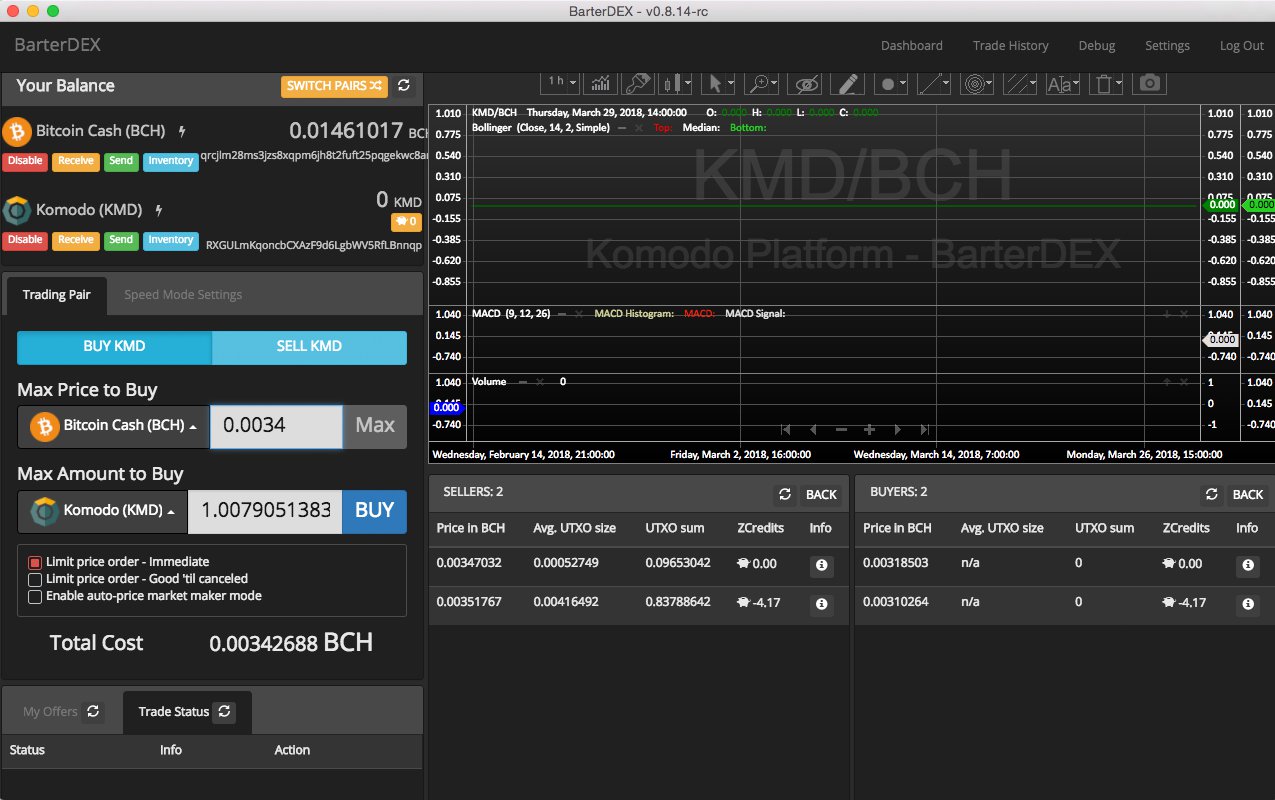

The Komodo project is a public blockchain with an associated token called KMD, and the team has also created a decentralized exchange platform called Barterdex. The open source software allows users to trade cryptocurrencies across multiple blockchain networks using a technique called atomic swaps. An atomic swap is a method of trading between two blockchain networks without relying on the use of a third party intermediary. The platform has a user-friendly interface but needs more liquidity across most trading pairs.

Peer-to-Peer Order Book

What’s interesting about Barterdex is in contrast to other Dex protocols like the NXT and Bitshares competitors is that the platforms order books are peer-to-peer and decentralized. Komodo developers say the order book system is “analogue of a full relay node and a node that doesn’t relay.” All buys and sells are displayed for traders and updates are frequently propagated throughout the network.

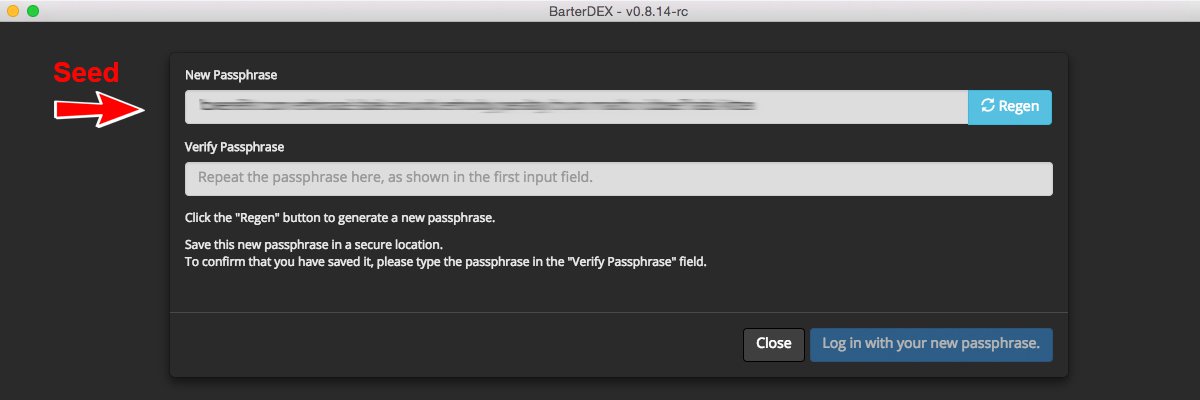

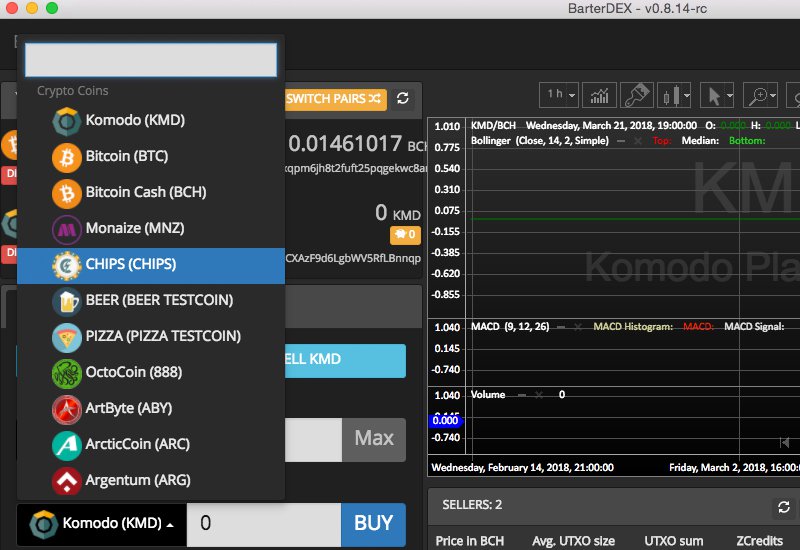

There is a wide variety of cryptocurrencies to swap with, but some have a lot more volume than others and trading these coins will produce faster results if you are experimenting. When Barterdex app loads, users are given a twelve-word mnemonic phrase and asks you to copy the information like any other private wallet seed. After writing down the mnemonic phrase, users are greeted with a window that displays a portfolio data, and recently visited markets. There’s also a window for trade history, a debug menu, and a settings section where you can change the theme and language.

A Successful BCH for KMD Swap

In order to get started, you need to choose which currency you want to use to trade and which digital asset you want. You then need to deposit the coin to a smart address if to complete an atomic swap offer across the exchange’s network of peers. A full confirmation for the transaction is needed to see the deposit and get started using Barterdex. After the deposit confirms you can then select which currency you want to buy with the cryptocurrency you just added. To find some markets with good volume, you can peruse through a lot of well-known coins to offer a trade or look for peers by populating the list of offers.

After roughly 30 minutes of testing the platform and waiting for a trade to execute the coins had finally swapped. Given the fact that one of the Komodo developers gave us some instructions it helped make the process run a touch more smoothly. Otherwise, it’s good to have some knowledge on how to use any cryptocurrency exchange and understand a basic order book process.

More Traders Needed

Much like Bisq, and the new Bittorrent application Joystream, the Barterdex platform needs more active traders. Most of the waiting is due to figuring out which coins have better liquidity, and waiting for a trade to be accepted across the network. The platform definitely works, the interface is sharp and charts are updated regularly. The use of decentralized exchanges is still light across the board, and this factor is the case for all of the trading platforms that enable cryptocurrency swaps without a third party. It’s safe to say it’s going to take some time for traders to leave centralized exchanges for platforms like these.

Have you tried the Barterdex exchange? Let us know what you think about this trading platform in the comments below.

Images via Barterdex, Shutterstock, and Jamie Redman.

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post Testing Cryptocurrency Atomic Swaps With Barterdex appeared first on Bitcoin News.

Powered by WPeMatico