Okex has promised to roll back futures transactions after irregular activity saw bitcoin plunge to under $4,800. The incident triggered massive liquidations, wiped out hundreds of contracts, and saw one trader threaten to commit suicide in front of Okex’ Hong Kong offices.

Also read: Hacked Cryptocurrency Exchange Youbit Re-Emerges Amid Insurance Controversy

Okex Reverses the Rekoning

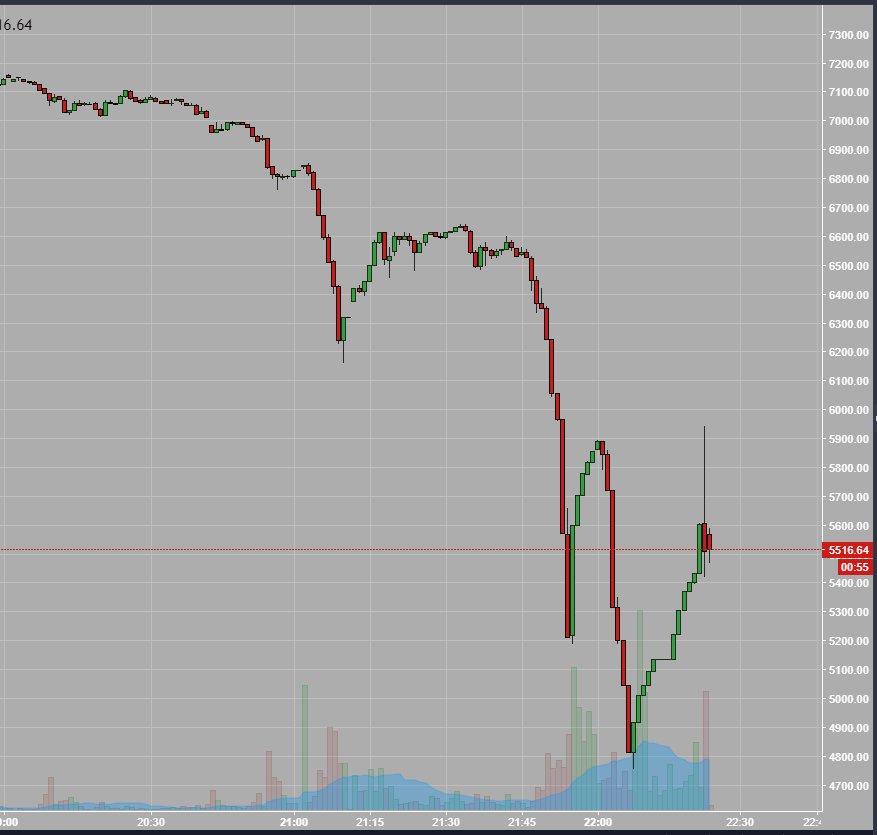

Cryptocurrency trading in the current climate is tough enough without being subjected to illegal liquidations. On Friday March 30, anomalies at the Chinese-run Okex exchange saw millions of dollars wiped out from trading accounts after a flash crash obliterated long positions. Vociferous protestations from Okex customers included one individual arriving at the firm’s Hong Kong HQ branding what he claimed to be a bottle of poison. The man claimed to have lost $10 million through forced liquidation, and threatened to drink the liquid if the matter wasn’t rectified.

Cryptocurrency trading in the current climate is tough enough without being subjected to illegal liquidations. On Friday March 30, anomalies at the Chinese-run Okex exchange saw millions of dollars wiped out from trading accounts after a flash crash obliterated long positions. Vociferous protestations from Okex customers included one individual arriving at the firm’s Hong Kong HQ branding what he claimed to be a bottle of poison. The man claimed to have lost $10 million through forced liquidation, and threatened to drink the liquid if the matter wasn’t rectified.

In a statement issued on March 30, Okex wrote: “To prevent forced-liquidations due to price differences after the settlements in “bi-weekly” and “quarterly” futures contracts, we will rollback the transactions as mentioned, and all futures contracts will be delivered at 00:00 Mar 31, 2018 (Hong Kong Time). Further announcement will be made if there are any changes in delivery time.”

The exchange has promised to reset futures contracts to 4:47 Mar 30, 2018 Hong Kong time and apologized to traders affected by the sudden liquidation. While bitcoin’s price action has been choppy for days, Okex is the only exchange to have been affected so profoundly. While BTC was dipping under $4,800 on Okex, which is owned by Okcoin, it held $7,000 everywhere else.

Forced Liquidations Leave a Bitter Taste

Margin and futures trading is a risky business, but remains popular with traders, as the rewards for predicting where bitcoin will move next can be substantial. The extreme dip that occurred on Okex was clearly an anomaly, though, that traders could not have seen coming. The exchange is investigating the matter to determine whether it was the result of a technical error or manipulation.

Do you think Okex is right to roll back the liquidated contracts? Let us know in the comments section below.

Images courtesy of Shutterstock, Twitter, and Okex.

Need to calculate your bitcoin holdings? Check our tools section.

The post Okex Rolls Back Futures Contracts After Liquidations Leave Traders Reeling appeared first on Bitcoin News.

Powered by WPeMatico