Last time, analysts blamed Mt. Gox and its bankruptcy trustee for pushing hordes of bitcoin onto an already fragile market, crushing its price. Keen monitors of the notorious insolvent exchange’s wallets showed how 16,000 BTC, along with its equivalent in bitcoin cash, were moved, sparking concern the broader market could once again be impacted.

Also read: Philippines Welcomes Crypto Economic Zone

Market Steadies for Another Possible Mt. Gox Bitcoin Dump

By any metric, 16,000 is a lot. At current bitcoin cash (BCH) prices, that translates to almost $21 million. In bitcoin core (BTC), as of this writing, that’s nearly $141 million. What such amounts flung onto open markets might do is anyone’s guess, but economics isn’t kind to prices of assets when their supply outstrips demand. In other words, they’ll probably lower.

Cryptoground, which was banned from the subreddit /r/mtgoxinsolvency, shows how four Mt. Gox wallets, each with about 2,000 BTC, were zeroed out today. The equivalent in BCH, in four moves, appears to have been shuffled as well, according to block explorers.

Presently, the Mt. Gox crypto exchange’s remaining coins are entrusted to Nobuaki Kobayashi, a lawyer based in Tokyo, Japan. Something like 146K BTC remains under Mr. Kobayashi’s stewardship.

Presently, the Mt. Gox crypto exchange’s remaining coins are entrusted to Nobuaki Kobayashi, a lawyer based in Tokyo, Japan. Something like 146K BTC remains under Mr. Kobayashi’s stewardship.

The Mt. Gox fiasco of 2014 represents a steep learning curve in cryptocurrency’s brief history. It’s a fascinating subject, one of putting too much trust in a third party, something cypherpunks warned about long ago. Indeed, the very point of bitcoin was to subvert exactly that. Mt. Gox was hacked, funds stolen, some returned or found, and a price slump took months (some say years) for markets to recover. The exchanged was deemed insolvent and formally placed in receivership, and attempts have been made at making creditors whole ever since, dumps included.

Future Sale Looms

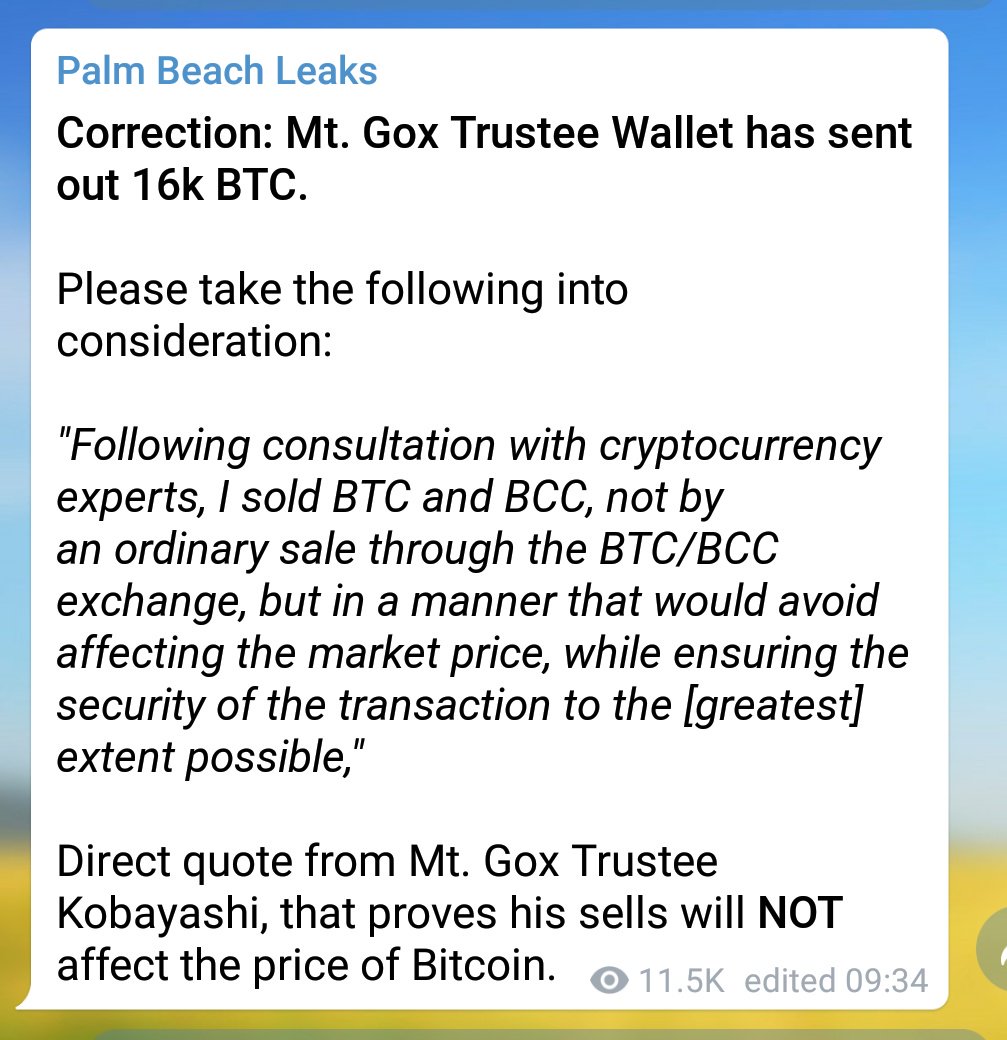

Previously, a 24-page report released by Mr. Kobayashi in Spring of this year, detailing how hundreds of millions of dollars worth of BTC and BCH had been sold, roughly 35k and 34k respectively. “As a result of the consultation with the court, I considered it necessary and reasonable to sell a certain amount of BTC and [BCH] at this point and secure a certain amount of money for distribution resources, and thus, I sold the amount of BTC and [BCH above. I made efforts to sell BTC and [BCH] at as high a price as possible in light of the market price of BTC and [BCH] at the timing of sale.” Ominously, he noted, “I plan to consult with the court and determine further sale of BTC and [BCH].”

For enthusiasts and investors alike, past Mt. Gox dumps have resulted, they believe, in price downturns, some dipping by as much as over half, as was the case in February of this year. In the case of over the counter markets (OTC), traders might wish to undershoot, arbitrage, the 16,000 coins by several hundred dollars. The traders then might shift those discounted coins to retail exchanges, taking profits at the expense of the ultimate price.

Some have latched onto the September 18th, 2018 date as the earliest such coins could conceivably be sold, and that was widely reported. As one enthusiast (岩井洋一(柔術新聞 速報版)) responded, however, “Hi, I’m Japanese. Nobuaki has already authorization to sell BTC. Sep 18 is only schedules of Creditors’ meeting. It’s has not any authorization of selling BTC. Nobuaki says he will sell BTC with court permission.” Still others have suggested the recent drop in BTC price after a short bull run might’ve been caused by such coins already having been dumped.

Do you think the coins will be dumped? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Bitcoin Markets Steady for Another Gox Dump, 16,000 Coins Moved by Trustee appeared first on Bitcoin News.

Powered by WPeMatico