Japan’s Financial Services Agency, tasked with monitoring the country’s cryptocurrency exchanges, has quietly been pressuring platforms to delist privacy coins. Coincheck has already done so in the wake of the $400 million NEM hack. If fellow exchanges follow suit, it could signal the beginning of the end for privacy coins such as zcash and monero on Japanese and possibly even global exchanges.

Also read: Bitcoin Cash Adoption Continues: Crypto Cafebar, Gold Vendor, Concealed-Carry Clothing

FSA Gives Privacy Coins the Thumbs Down

Japan’s FSA is reportedly urging exchanges to move away from privacy coins, which it associates with money laundering, drug dealing and other nefarious activities. Coins such as monero, zcash, and dash all fall into this category, even though the latter two provide opt-in privacy only, a feature that most users don’t enable. Forbes reports sources close to the FSA as confirming that the regulator is clamping down on anonymous currencies because they are difficult to trace.

Japan’s FSA is reportedly urging exchanges to move away from privacy coins, which it associates with money laundering, drug dealing and other nefarious activities. Coins such as monero, zcash, and dash all fall into this category, even though the latter two provide opt-in privacy only, a feature that most users don’t enable. Forbes reports sources close to the FSA as confirming that the regulator is clamping down on anonymous currencies because they are difficult to trace.

The news, while not surprising, is nevertheless concerning. Many of crypto’s most passionate advocates were attracted to the technology in the first place for its ability to provide a measure of anonymity on an increasingly surveilled and privacy-free internet. Without optional anonymity, or at least pseudonymity, cryptocurrencies lose much of their appeal, and individuals lose their right to send payment to their peers without broadcasting their intentions to the world.

“Problematic” Monero Gets the Heave-Ho

If there’s one privacy coin that unites global lawmakers and regulators in their condemnation, it’s monero. At a meeting on April 10, Forbes reports that “Monero and Dash were both mentioned as highly problematic virtual currencies”. If true, the FSA appears to view privacy coins the way law enforcement forces view encryption: they don’t like it because it works – all of the time, and for all the people, be they good or bad.

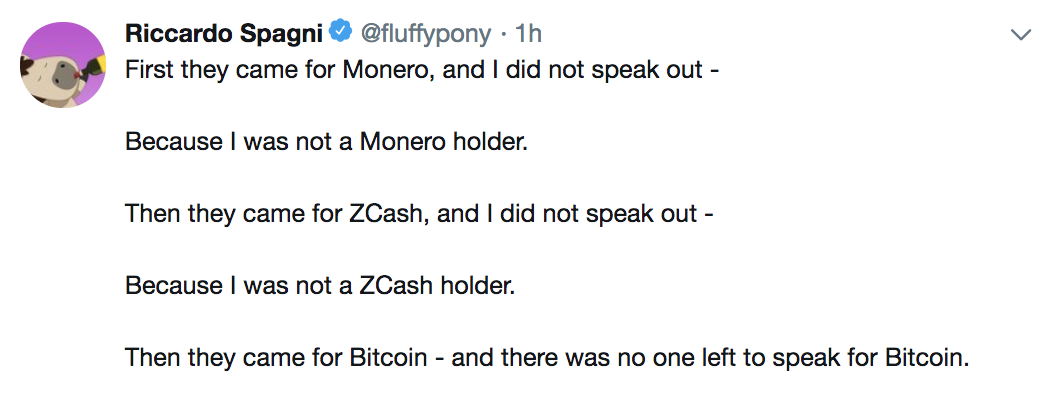

In response to this news, monero lead developer Riccardo Spagni tweeted a popular anti-censorship quote:

The jocular “Fluffypony” has a point. Japan’s crackdown on privacy coins could be the thin end of the wedge, presaging a global ban enforced by compliant exchanges. This isn’t as far-fetched as it might sound. It’s already widely assumed, for example, that Coinbase will never list a privacy coin for fear of irking the regulators it has spent years cozying up to. While no exchange wants to be accused of complicity in criminality, Coinbase has a particular aversion to anything that could be remotely associated with vice – which, rightly or wrongly, means any coin with privacy built in.

Due to its dominant position in the cryptoconomy, where Japan leads other nations tend to follow. If privacy coins were to be delisted, first in Japan, and then globally, it risks creating a two-state crypto economy: one highway for the compliant, regulated and fully KYC’d, and a darker lane for the privacy lovers, who buy they coins on unregulated exchanges and are tarred with the same brush as terrorists and money launderers.

Do you think privacy coins are in danger of being delisted en masse by global exchanges? Let us know in the comments section below.

Images courtesy of Shutterstock, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post Japanese Regulator Pressures Exchanges to Drop Privacy Coins appeared first on Bitcoin News.

Powered by WPeMatico