As the world’s largest exchange, Binance commands huge amounts of power. It can charge whatever it likes for a listing in the knowledge that altcoin projects will still cough up in return for the liquidity and legitimacy that a Binance listing brings. With great power comes great responsibility however, and some of the exchange’s new additions have a chequered past.

Also read: How to Shuffle Your BCH Coins Like a Boss

Binance Swallows Up Bytecoin

As one of the oldest and least fashionable cryptocurrencies on the market, bytecoin was an unexpected addition to Binance. The exchange is more accustomed to listing the latest “must-have” tokens such as Wanchain, but appears willing to add any coin if the price is right. The addition of bytecoin (BCN), as well as other recent listings, has had some traders scratching their heads. BCN is a controversial coin due to an allegedly huge pre-mine when it launched in 2014. It then effectively disappeared off the radar before resurfacing last year.

Until its appearance on Binance on May 8, bytecoin was only available on the unfashionable Stocks.Exchange, Hitbtc, and Poloniex. As much as 82% of the coin’s supply is believed to be in the hands of one entity, or a handful of entities at best, and it is also alleged to be susceptible to an infinite inflation bug that allows coins to be created out of thin air. This latter flaw may have now been fixed, but tellingly Onchainfx still lists BCN as a scamcoin alongside the likes of Bitconnect.

Binance, Bytecoin, and the Big Pump

Regardless of bytecoin’s murky past, its present is just as dubious. Every coin that is listed on Binance can expect an instant pump, but BCN’s was significantly higher than usual – and its fall equally spectacular. The coin rose by 270% in three hours before plummeting, leaving its daily gains at “just” 71%. Coin comparison site Coincodex called foul play as massive price discrepancies for BCN appeared between Binance and Poloniex. In a blog post, Coincodex wrote:

Who in the world was buying BCN at a price which was 10 times higher than elsewhere? Perhaps there were some unwitting traders who didn’t want to miss out on a token that was going vertical and bought before checking prices on other exchanges, but it seems very unlikely that BCN trading activity on Binance today was entirely organic.

Shortly after being listed on Binance, the bytecoin network stopped confirming transactions, prompting Poloniex to halt BCN withdrawals. According to Bytecoin, this was due to the network experiencing “unusually high load”, likely a consequence of BCN holders rushing to transfer their coins to Binance to catch the pump. Binance later issued its own update, advising users to “Please be cautious of high price volatility and trade with caution.”

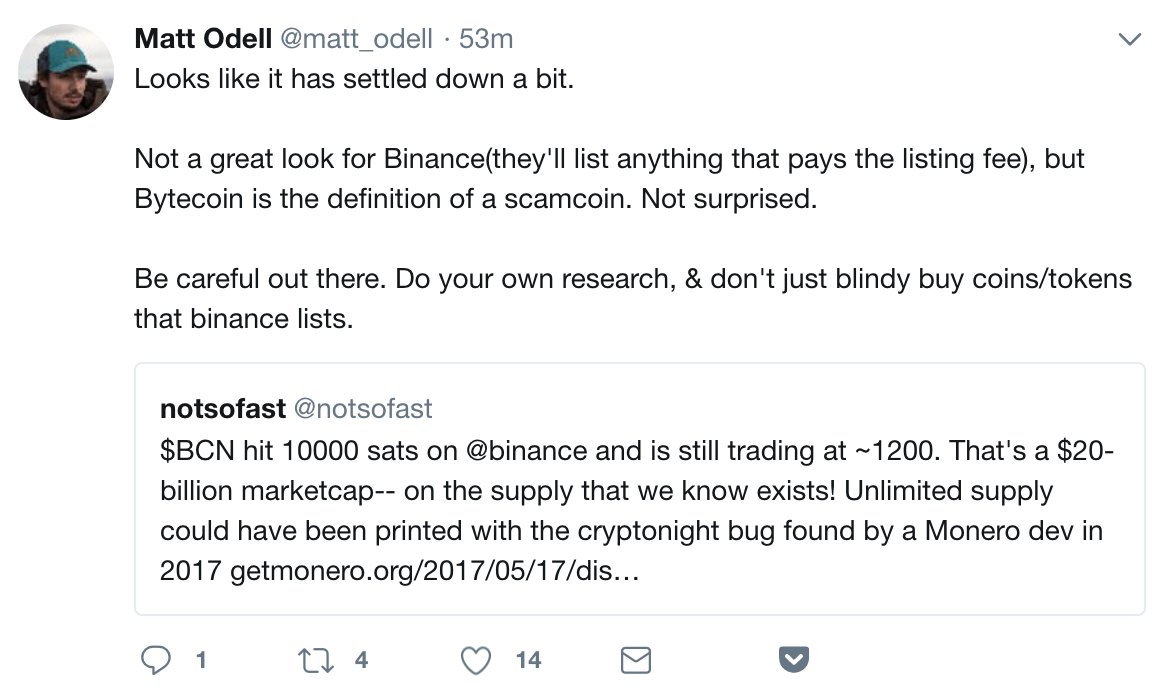

It is Binance’s prerogative to list whatever coins it likes, and it is not responsible for the prices that traders choose to pump coins to. Given the murky nature of bytecoin’s past, however, coupled with concerns over who owns the bulk of the circulating supply, it is hard to see how the community benefits from BCN being added to Binance. For so long as the exchange dominates the market, altcoins will clamor to be listed and traders will compete to catch the pump, regardless of the coin’s fundamentals.

Do you think bytecoin is a scamcoin, or is it a legitimate cryptocurrency? Let us know in the comments section below.

Images courtesy of Shutterstock, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post Binance’s Coin Listing Policy Raises Questions appeared first on Bitcoin News.

Powered by WPeMatico