Every good trader knows their TA from their FA, and can appreciate the effect that fundamental and technical analysis have on market movements. But what about SA? Sentiment analysis, which involves making decisions based on the emotions of other traders, is arguably just as important, especially in the cryptocurrency market, where a herd mentality prevails.

Also read: South Korea’s Largest Crypto Exchange Upbit Under Investigation for Fraud

Other People’s Feelings Matter

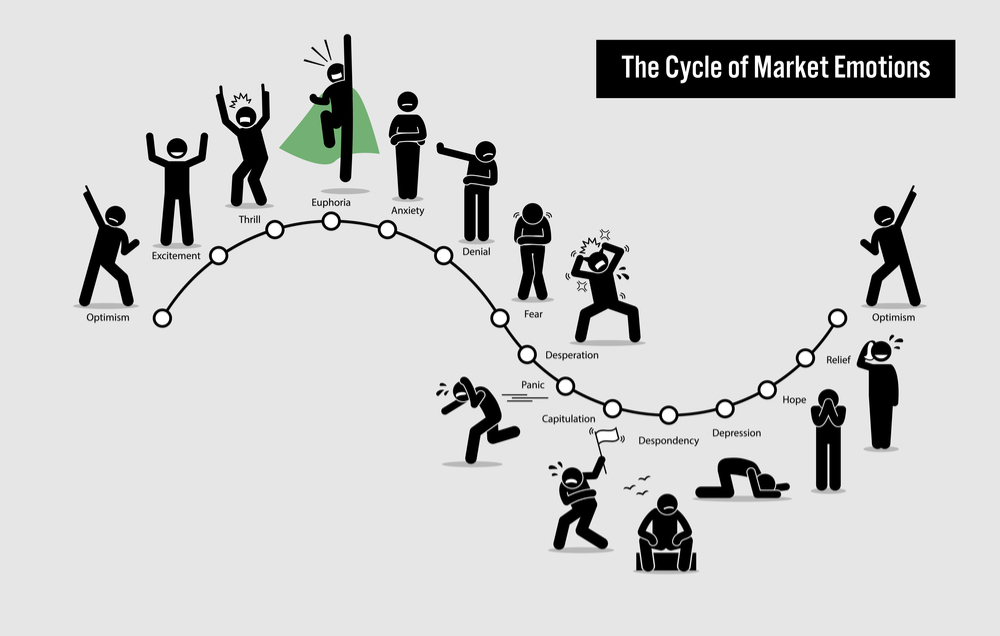

“Don’t trade on your emotions” is one of the first rules a trader learns, because making yourself a hostage of FOMO, and all the feelings that come with it – remorse; euphoria; despondency – is a recipe for disaster. But what about trading on the emotions of others? You might be a mechanistic trading automaton, with your unbridled emotions kept in check, but the rest of the market is not, and it’s their decisions – no matter how irrational – that move markets, not yours.

As an example of sentiment analysis, consider the periodic bitcoin movements of the Mt Gox trustee. Every time he sends a tranche of coins to a different address, BTC dumps. Technically, this occurs because people are anticipating that when he offloads 8,000 BTC onto the open market it will cause a flash crash. And yet the trustee has provided reassurances that he is not selling his coins in such a manner, yet BTC still drops the moment he moves coins. The only interpretation is that traders are anticipating other traders dumping BTC on the news and are clamoring to sell first. Even if you have faith in the trustee’s intentions, simple sentiment analysis tells you to sell.

There’s a Fine Line Between TA, FA, and SA

Technical, fundamental, and sentiment analysis are disciplines which intersect. Even if you’ve not been overtly factoring SA into your trading, it will have influenced your decisions. For example, a number of cryptocurrency traders have little love for Tron (TRX) which they deem to be a shitcoin. That doesn’t stop them from speculatively buying it though any time it’s dropped to a previous support level. Why? Because they know it’s almost certain to pump again for reasons that cannot be rationally explained using TA or FA. The same applies to other “penny cryptos” like verge.

Sentiment analysis is basically a self-fulfilling prophecy: that if enough traders believe in X, then X comes to be true. For example, do coins pump by 100% when they are listed on Binance because of the increased liquidity and wider investor access this brings? Or do they pump because everyone expects them to pump, and so everyone panic buys in a race to the top? Then there are coins like IOTA, which has a tendency to rise in price every time someone publishes negative news about it, which is a frequent phenomenon. One interpretation of IOTA’s immunity to “FUD” is that its community stubbornly buys up more of it during times of crisis as a gesture of defiance.

Tools for Measuring Sentiment Analysis

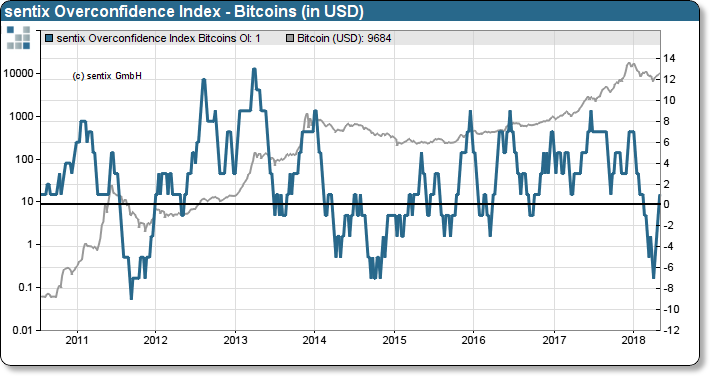

You won’t find an SA overlay in Tradingview, but there are tools that provide a crude reckoner of overall market sentiment at a given point in time. One example is the Fear & Greed Index that charts emotions and sentiments from a range of aggregated sources. Right now, we’re in “fear”, but that’s still an improvement on last month’s “extreme fear”. Crypto Sentiment provides a more comprehensive set of SA tools including an index of strategic bias and an overconfidence index that “reflects the risk that investors might take to risky positions based on the behavior of the bitcoin price”.

When trying to time their entry and exit points, good traders already factor in sentiment analysis. They might not explicitly refer to it by name, but they know it when they see it. For all the automated tools, bots, and indicators that have been developed over the years, markets remain deeply irrational and hostage to human emotion. Many traders are predicting a strong bitcoin and altcoin bounce in the wake of next week’s Consensus summit. Why? Because that’s what happened last year. It doesn’t matter if last year’s bull run was a coincidence: all that matters is that if enough investors expect the same to occur this year, it will occur. Once a belief takes root, feelings trump technicals every time.

Do you think sentiment analysis is a useful trading tool? Let us know in the comments section below.

Images courtesy of Shutterstock, Alternative.me and Crypto-sentiment.com.

Need to calculate your bitcoin holdings? Check our tools section.

The post Sentiment Analysis Is the Best Trading Tool You’re Not Using appeared first on Bitcoin News.

Powered by WPeMatico