This week the Federal Reserve Bank of St. Louis added cryptocurrency to their Federal Reserve Economic Data (FRED) database. It’s a seemingly small gesture, but one that signals to most observers crypto’s maturation, at least in the eyes of arguably the most important central banking institution in the world.

Also read: Troll Slayer: Derek Magill Defends Peer-to-Peer Electronic Cash Against Defamation

Federal Reserve Bank of St. Louis Adds Four Cryptos to its FRED Database

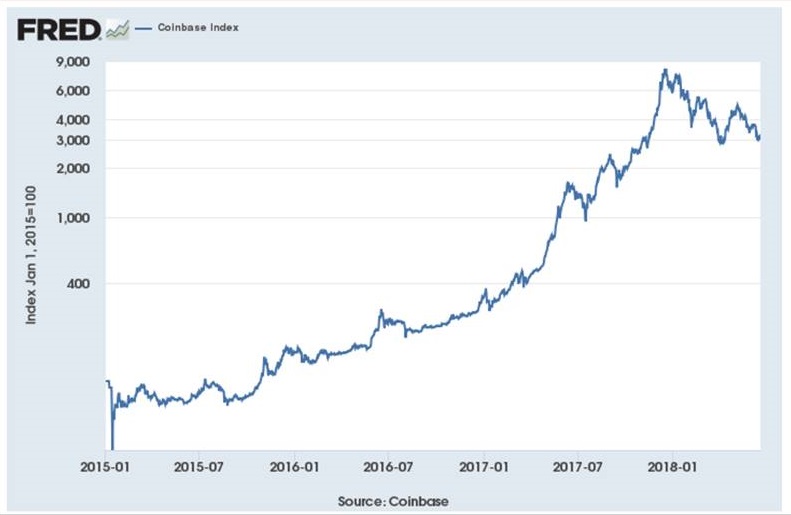

“FRED has added four series on the prices of different cryptocurrencies,” the St. Louis Federal Reserve posted without much fanfare this week, including “Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. The price data are updated daily and span from as early as 2014 to the present. All data were obtained from Coinbase, a cryptocurrency exchange company, whose overall digital asset performance is depicted in the above graph (Coinbase Index).”

The St. Louis Fed is one of 12 regional banks within the system, collectively constituting the most powerful central bank on the globe. Known to be part of the 8th District, which includes midwestern Fed banks, it is also considered an economic research powerhouse.

It maintains its FRED database at its famed research division. The bank uses more than half of a million data points, derived from 81 sources. Exchange rates, GDP, interest rates, consumer indexes, banking, producer price indexes, among other sectors, comprise its focus. FRED-published statistics carry massive weight in the professional financial world.

That some government agency creates yet another index isn’t particularly newsworthy. However, that both proponents and opponents frequently set cryptocurrencies such as bitcoin cash (BCH) as distinctly operating in defiance of central banks, and how the Fed appeals to crypto bank Coinbase for its metric, means decentralized currencies have come of age.

Out Ahead

Going forward, it would also appear as Coinbase adds more currencies perhaps FRED would be compelled to monitor them as well. Whatever the case, the St. Louis Fed has been consistently out ahead of most central banks and economists when it comes to crypto.

That’s a marked contrast to its brethren. Atlanta’s Fed bank openly chastised younger investors to steer clear of crypto. The San Francisco branch pegged bitcoin core’s (BTC) price considerably lower than its near $6,000 present figure, insisting one BTC is probably worth around the cost of mining, slightly under $2,000 per coin. Even the Minneapolis Fed, in trying to be charitable, urged ignoring the currency aspect altogether and instead look toward ‘blockchain technology.’

Again, the St. Louis Fed thinks differently. Just a few months ago it caused a stir within the ecosystem by publishing a meditation on BTC, putting forth the idea it can be considered alongside the dollar. Its Governor James Bullard, however, is much more cautious. Acknowledging crypto as being a real future of money, he explained, “Cryptocurrencies may unwittingly be pushing in the wrong direction in trying to solve an important social problem, which is how best to facilitate market-based exchange.”

Is the arrival of a FRED crypto index important? Let us know in the comments.

Images via the Pixabay, FRED.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi Pulse, another original and free service from Bitcoin.com.

The post US Federal Reserve Launches Cryptocurrency Index appeared first on Bitcoin News.

Powered by WPeMatico